Equinor (EQNR) Defers Bay du Nord Oil Project Offshore Canada

Equinor ASA EQNR decided to defer its innovative Bay du Nord oil project offshore Canada for up to three years.

Discovered in 2013, Bay du Nord is situated in the Flemish Pass region off the coast of Newfoundland and Labrador. Once completed, it will be the first deepwater drilling site in Canada. The project operated by Equinor is expected to be valued at more than $12 billion.

The project was initially delayed due to rising expenses and the coronavirus pandemic. However, the project was resumed after some nearby discoveries increased resources and potentially secured the environmental all-clear from Ottawa.

Equinor and partners will postpone the Bay du Nord project to enhance project robustness despite the volatile market conditions. In recent months, the Bay du Nord project experienced significant expenditure growth mostly due to volatile market conditions.

Bay du Nord involves five discoveries with significant additional near-field prospectivity. Equinor continues to evaluate exploration drilling around the Bay du Nord field in 2024. The company can drill two more prospects — Sitka and Bakeapple.

Bay du Nord will be a key driver to help meet the global oil demand, while supporting the country's pledge to carbon neutrality by 2050. The project is also crucial to the Newfoundland and Labrador economy, as it will provide significant employment and economic opportunities.

Canada is one of Equinor’s core areas. Through Bay du Nord, the company maintains a strong business in the country. EQNR will utilize the postponement to continue to mature Bay du Nord toward successful development.

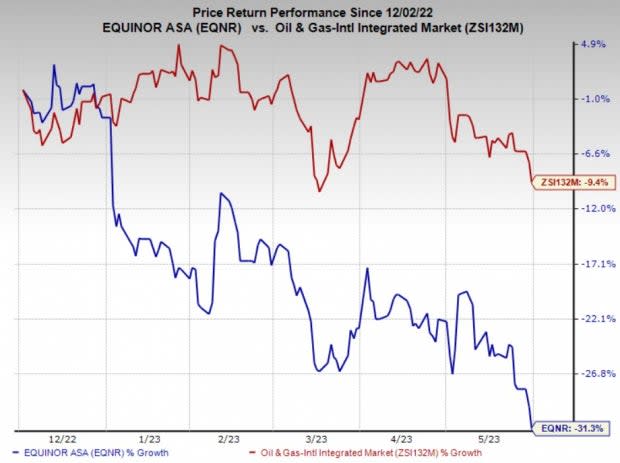

Price Performance

Shares of EQNR have underperformed the industry in the past six months. The stock has lost 31.3% compared with the industry’s 9.4% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Some better-ranked players in the energy space are Enterprise Products Partners LP EPD and Sunoco LP SUN, each currently sporting a Zacks Rank #1 (Strong Buy), and Murphy USA Inc. MUSA, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enterprise Products reported first-quarter 2023 adjusted earnings per limited partner unit of 64 cents, which beat the Zacks Consensus Estimate of 62 cents. This was primarily due to higher contributions from the Natural Gas Pipelines & Services business.

In the first quarter, Enterprise Products generated an adjusted free cash flow of $1,347 million against a negative free cash flow of $1,618 million in the year-ago quarter. EPD recorded a distributable cash flow of $863 million in the same time frame.

Sunoco reported first-quarter 2023 earnings of $1.41 per unit, beating the Zacks Consensus Estimate of $1.21. Better-than-expected quarterly earnings were primarily driven by higher contributions from the Fuel Distribution and Marketing segment.

For 2023, SUN revised its adjusted EBITDA guidance upward to $865-$915 million from the previously mentioned $850-$900 million.

Murphy USA announced first-quarter 2023 earnings per share of $4.80, which beat the Zacks Consensus Estimate of $4.06. The outperformance can be attributed to higher volumes and retail fuel contribution.

MUSA is committed to returning excess cash to its shareholders through continued share buyback programs. As part of this initiative, the motor fuel retailer recently approved a repurchase authorization of up to $1.5 billion following the completion of the existing $1-billion mandate. The move underscores MUSA’s sound financial position and commitment to rewarding its shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance