Equinor (EQNR) Awarded Oil & Gas Production Licenses in Norway

Equinor ASA EQNR has been awarded 26 production licenses by the Norwegian Ministry of Petroleum and Energy in the Awards in Predefined Areas 2022.

Norway offered interests in one or more production licenses to 25 energy companies, from large international majors to small domestic exploration firms.

Norway awarded ownership interests in 47 oil and gas production licenses on the Norwegian Continental Shelf. Of the total, 29 production licenses are in the North Sea, 16 are in the Norwegian Sea and the rest are in the Barents Sea.

Equinor won 26 licenses, wherein 16 are in the North Sea, nine are in the Norwegian Sea and one is in the Barents Sea. It won 18 licenses as an operator and eight as a partner. The other prominent winners are Aker BP, Var Energi, DNO ASA, Wintershall Dea, OKEA ASA and Neptune Energy.

Equinor is committed to accelerating exploration and production activities across the Norwegian Continental Shelf. In 2023, EQNR plans to drill 25 exploration wells near existing infrastructure and mostly in the North Sea.

Equinor will drill 80% of the exploration wells in mature areas. Discoveries near existing infrastructure require less volume to be commercially developed and can be brought online with low carbon emissions. The production licenses add significant opportunities to Equinor’s exploration portfolio.

The awards complement Equinor’s strategy to maximize value creation through existing infrastructure and seek insights to create growth opportunities. These are valuable contributions to maintaining exploration activities and making significant discoveries on the continental shelf.

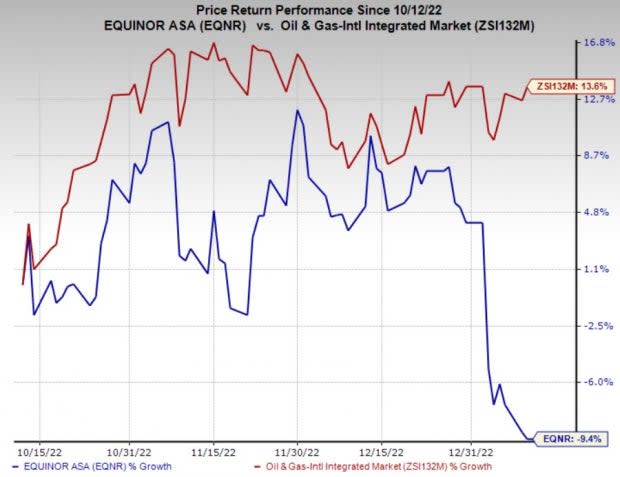

Price Performance

Shares of EQNR have underperformed the industry in the past three months. The stock has lost 9.4% against the industry’s 13.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Equinor currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

RPC Inc. RES is among the leading providers of advanced oilfield services and equipment to almost all prospective oil and gas shale plays in the United States. RES’ adjusted earnings of 32 cents per share in the third quarter beat the Zacks Consensus Estimate of 25 cents.

RPC is expected to see an earnings surge of 2,933.3% in 2022. With no debt load, RPC had cash and cash equivalents of $35.9 million at the third-quarter end. This reflects the company’s strong balance sheet, providing it with massive financial flexibility and allowing it to remain afloat during tough times.

MPLX LP MPLX is a master limited partnership that provides a wide range of midstream energy services, including fuel distribution solutions. MPLX’s third-quarter earnings of 96 cents per unit beat the Zacks Consensus Estimate of 81 cents.

MPLX is expected to see an earnings rise of 35.3% in 2022. MPLX’s distribution per unit was 77.5 cents for the third quarter, indicating a 10% hike from the prior distribution of 70.5 cents.

Halliburton Company HAL is one of the largest oilfield service providers in the world. HAL’s third-quarter 2022 adjusted net income per share of 60 cents surpassed the Zacks Consensus Estimate of 56 cents.

HAL is expected to see an earnings surge of 94.4% in 2022. With controlled capital spending and strong demand for its products/services, Halliburton expects to generate strong free cash flows going forward. We expect the free cash flow to be more than $1.1 billion in 2022, jumping to $1.9 billion in 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance