If You Like EPS Growth Then Check Out JEMTEC (CVE:JTC) Before It's Too Late

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in JEMTEC (CVE:JTC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for JEMTEC

JEMTEC's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that JEMTEC grew its EPS from CA$0.062 to CA$0.22, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

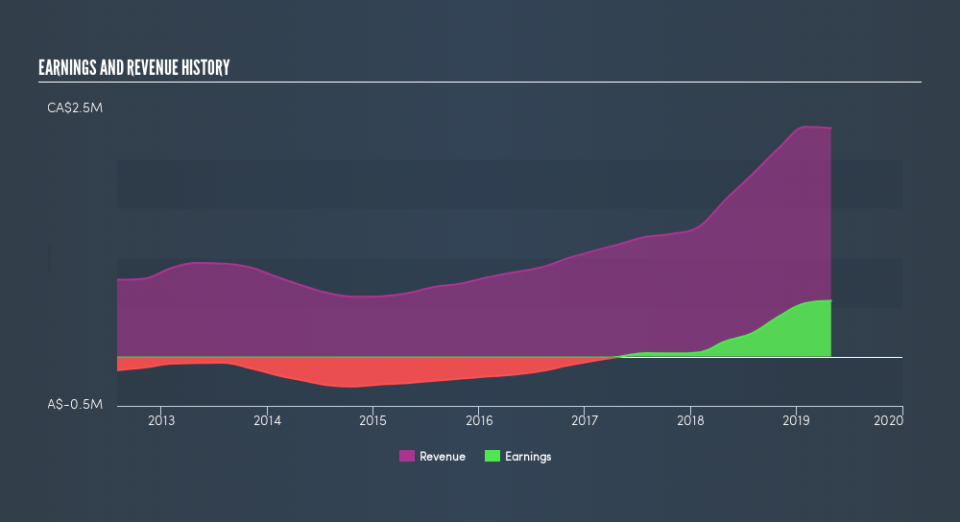

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. JEMTEC shareholders can take confidence from the fact that EBIT margins are up from 9.7% to 25%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

JEMTEC isn't a huge company, given its market capitalization of CA$6.2m. That makes it extra important to check on its balance sheet strength.

Are JEMTEC Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that JEMTEC insiders netted -CA$7.1k worth of shares over the last year. On the other hand, Paul Crossett paid CA$25k for shares, at a price of about CA$1.26 per share. So, on balance, that's positive.

And the insider buying isn't the only sign of alignment between shareholders and the board, since JEMTEC insiders own more than a third of the company. In fact, they own 54% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, JEMTEC is a very small company, with a market cap of only CA$6.2m. That means insiders only have CA$3.4m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Is JEMTEC Worth Keeping An Eye On?

JEMTEC's earnings per share have taken off like a rocket aimed right at the moon. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. Now, you could try to make up your mind on JEMTEC by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of JEMTEC, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance