With EPS Growth And More, Parkland Fuel (TSE:PKI) Is Interesting

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Parkland Fuel (TSE:PKI). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Parkland Fuel

Parkland Fuel's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Parkland Fuel's stratospheric annual EPS growth of 46%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

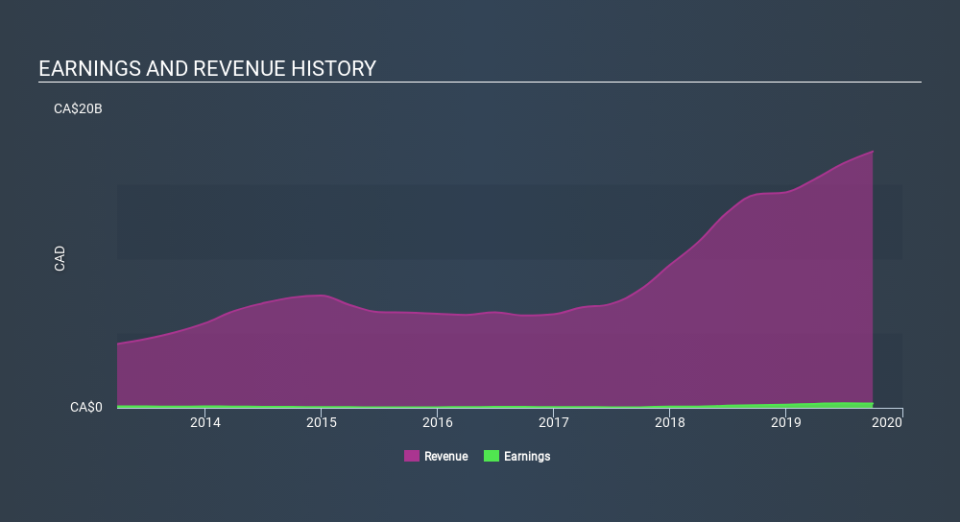

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Parkland Fuel's EBIT margins were flat over the last year, revenue grew by a solid 20% to CA$17b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Parkland Fuel's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Parkland Fuel Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold -CA$2.6m worth of shares. But that's far less than the CA$12m insiders spend purchasing stock. This makes me even more interested in Parkland Fuel because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was Timothy Rhodes who made the biggest single purchase, worth CA$6.9m, paying CA$41.20 per share.

Along with the insider buying, another encouraging sign for Parkland Fuel is that insiders, as a group, have a considerable shareholding. Indeed, they hold CA$63m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Parkland Fuel Worth Keeping An Eye On?

Parkland Fuel's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Parkland Fuel belongs on the top of your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Parkland Fuel. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Parkland Fuel, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance