With EPS Growth And More, Gibson Energy (TSE:GEI) Is Interesting

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Gibson Energy (TSE:GEI). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Gibson Energy

Gibson Energy's Improving Profits

Over the last three years, Gibson Energy has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Gibson Energy's EPS soared from CA$0.89 to CA$1.15, over the last year. That's a impressive gain of 30%.

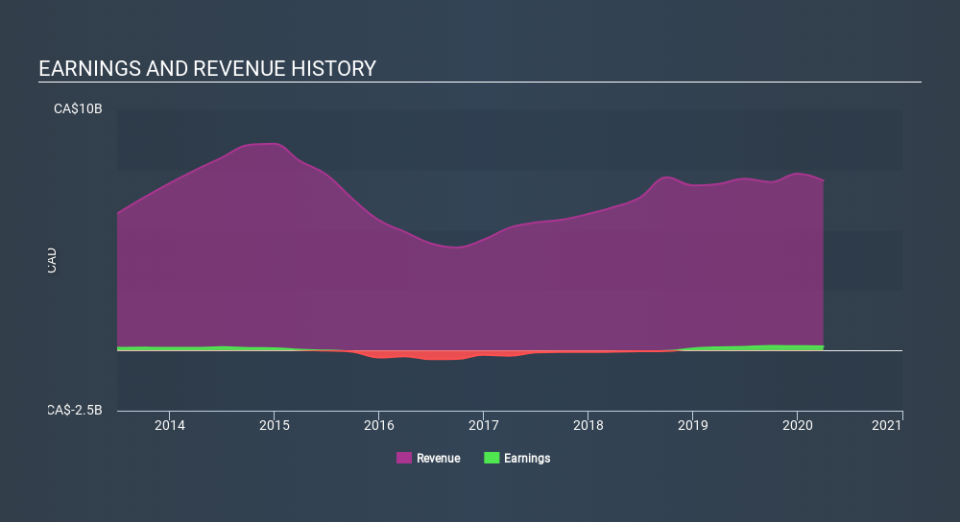

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Gibson Energy maintained stable EBIT margins over the last year, all while growing revenue 2.0% to CA$7.0b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Gibson Energy's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Gibson Energy Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Gibson Energy insiders did net -CA$3.8k selling stock over the last year, they invested CA$514k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Independent Director Douglas Bloom who made the biggest single purchase, worth CA$206k, paying CA$20.64 per share.

Should You Add Gibson Energy To Your Watchlist?

For growth investors like me, Gibson Energy's raw rate of earnings growth is a beacon in the night. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. To put it succinctly; Gibson Energy is a strong candidate for your watchlist. You still need to take note of risks, for example - Gibson Energy has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

As a growth investor I do like to see insider buying. But Gibson Energy isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance