EPAM Soars 12% as Q2 Earnings and Revenues Beat Estimates

EPAM Systems EPAM shares jumped 12.3% on Thursday after the company reported stronger-than-expected second-quarter 2022 results. The company reported second-quarter non-GAAP earnings of $2.38 per share, beating the Zacks Consensus Estimate of $1.71. The figure also improved by 16.1% year over year.

Revenues were $1.2 billion, reflecting a year-over-year increase of 35.6%. The top line surpassed the consensus mark of $1.14 billion. On a constant-currency (cc) basis, revenues were up 29.2%. Acquisitions completed in the last 12 months contributed 6.2% to the second-quarter top line.

The company continued to benefit from growth across multiple industry verticals and all geographies except for the Central and Eastern Europe (“CEE”) region. Digital transformation, a focus on customer engagement and product developments remained key catalysts.

Moreover, EPAM’s second-quarter performance reflects its resiliency amid massive business disruptions caused by the Russia-Ukraine war. In late February 2022, the company announced the discontinuation of its services in Russia in support of Ukraine.

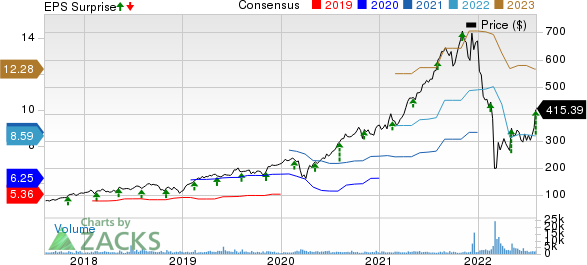

EPAM Systems, Inc. Price, Consensus and EPS Surprise

EPAM Systems, Inc. price-consensus-eps-surprise-chart | EPAM Systems, Inc. Quote

EPAM has significant exposure in the region, with the majority of its delivery centers in the CEE. The company’s largest delivery centers are in Belarus, Russia and Ukraine. As of Dec 31, 2021, it had approximately 9,000 and 12,400 employees in Russia and Ukraine, respectively.

However, following the Russia-Ukraine war, the company is trying to diversify its delivery locations by opening new sites across India, Latin America and Central and Western Asia.

Quarterly Details

Segment-wise, Business Information & Media climbed 25.4% year over year to $197.9 million and accounted for 16.6% of the company’s revenues.

Financial Services jumped 29.4% on a year-over-year basis to $251 million and accounted for 21% of revenues.

While Software & Hi-Tech was up 22.7% to $195.3 million, Travel & Consumer grew 61.1% to $276.3 million. Software & Hi-Tech and Travel & Consumer accounted for 16.3% and 23.1% of revenues, respectively.

Life Science & Healthcare climbed 40.1% year over year to $128.5 million and accounted for 10.8% of revenues. The Emerging segment improved by 36.1% year over year to $145.9 million and contributed 12.2% to revenues.

Geography-wise, EPAM generated 60.4% of the total revenues from the Americas, up 36.8% year over year. Revenues from the EMEA, contributing 35.4% to total revenues, jumped 45.2% year over year.

The Asia Pacific was up 20.8% and accounted for 2.5% of revenues. The CEE, representing 1.7% of revenues, plunged 46.7% year over year.

In the fourth quarter of 2021, EPAM renamed three out of four of its revenue geographies to account for the addition and growth of customers from the new locations. It renamed North America as the Americas, Europe as the EMEA and CIS (the Commonwealth of Independent States) as the CEE.

The total headcount was approximately 61,300 as of Jun 30, 2022.

EPAM’s non-GAAP operating income increased 14.3% year over year to $177.5 million. The non-GAAP operating margin contracted by 270 basis points to 14.9%.

Balance Sheet and Cash Flow

As of Jun 30, 2022, EPAM had cash, cash equivalents and restricted cash of $1.29 billion, up from $1.28 billion as of Mar 31, 2022.

As of Jun 30, 2022, the long-term debt was $30.2 million, up from $30.6 million as of Mar 31, 2022.

In the second quarter, EPAM generated operating and free cash flows of $77.5 million and $59.4 million, respectively.

Guidance

EPAM provided guidance for the third quarter of 2022. For the third quarter, the company estimates reporting GAAP revenues of at least $1.21 billion, suggesting year-over-year growth of at least 22%.

It expects foreign currency translation to have a negative impact of 4%. On a cc basis, it projects revenue growth of at least 26%, while acquisitions are likely to contribute approximately 4% to third-quarter revenues.

Management projects the non-GAAP operating margin in the 15-16% range. Non-GAAP earnings are expected at least $2.48 per share.

Citing uncertainties and the regional impacts of military actions in Ukraine, the company withdrew its 2022 financial guidance in late February. Earlier, it projected revenues of at least $5.150 billion for 2022, suggesting growth of at least 37% on a reported basis.

This includes a 1% unfavorable impact of foreign currency translation on revenues. EPAM was expecting acquisitions to contribute approximately 6% to top-line growth.

EPAM set the non-GAAP earnings guidance range to the $11.36-$11.69 per share range. The company forecast its non-GAAP operating margin guidance between 16.5% and 17.5%.

Zacks Rank & Stocks to Consider

EPAM currently carries a Zacks Rank #3 (Hold). Shares of EPAM have fallen 37.8% in the past year.

Some better-ranked stocks worth considering from the broader technology sector are Cadence Design Systems CDNS, Manhattan Associates MANH and 8x8, Inc. EGHT. Cadence Design Systems and Manhattan Associates each sport a Zacks Rank #1 (Strong Buy), while 8x8 carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cadence Design Systems' third-quarter 2022 earnings has been revised upward by nine cents to 97 cents per share over the past 30 days. For 2022, earnings estimates have moved north by 5.7% to $4.11 per share in the past 30 days.

Cadence Design Systems' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 9.8%. Shares of CDNS have decreased 0.4% YTD.

The Zacks Consensus Estimate for Manhattan Associates' third-quarter 2022 earnings has been revised upward by a penny to 57 cents per share in the past 30 days. For 2022, earnings estimates have moved south by 18 cents to $2.38 per share in the past 30 days.

Manhattan Associates' earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 30.3%. Shares of MANH have plunged 7.6% YTD.

The Zacks Consensus Estimate for 8x8's second-quarter fiscal 2023 earnings has been revised upward by a penny to four cents per share over the past seven days. For fiscal 2023, the Zacks Consensus Estimate for 8x8's earnings has moved north by 13 cents to 26 cents per share in the past seven days.

8x8's earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while matching the same in one, the average surprise being 175%. Shares of EGHT have plunged 73.3% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

EPAM Systems, Inc. (EPAM) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

8x8 Inc (EGHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance