Ensco Rowan (ESV) to Discontinue Quarterly Cash Dividends

Ensco Rowan plc ESV recently announced that it has suspended regular quarterly cash dividend payout. This is the company’s first update regarding dividends, since Ensco completed the acquisition of Rowan last April.

During the merger of the two companies, shareholders of Rowan received 2.750 Ensco shares per one Rowan share. Of the outstanding EnscoRowan shares, 55% and 45% are owned by legacy Ensco and Rowan shareholders, respectively.

Notably, prior to the merger, legacy Ensco shareholders were awarded with a regular quarterly dividend of a penny per share. On the contrary, legacy Rowan shareholders did not receive a regular quarterly cash dividend.

For full-year 2019 and beyond, EnscoRowan expects annual pre-tax expense synergies of about $165 million from the merger. Based on the anticipated annual savings, the union is likely to be accretive on a discounted cash flow basis.

The synergies from the deal are expected to create around $1.1 billion of capitalized value. As of Mar 31, Ensco Rowan had a contracted revenue backlog (excluding bonus opportunities) of $2.6 billion, providing the company with an excellent cash flow visibility.

Skipping the quarterly dividend payout might help EnscoRowan to focus on reducing the debt burden and improving balance sheet. As of Mar 31, the company had only $298.4 million in cash and cash equivalents, while long-term debt was more than $5 billion.

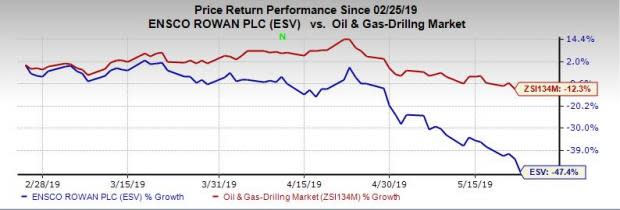

Price Performance

In the past three months, the stock plunged 47.4% compared with the 12.3% collective decline of the industry it belongs to.

Zacks Rank and Stocks to Consider

Currently, the stock carries a Zacks Rank #3 (Hold). Some better-ranked players in the energy space include Hess Corporation HES, Apache Corporation APA and Cactus, Inc. WHD. While Hess and Apache sport a Zacks Rank #1 (Strong Buy), Cactus holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess’ earnings are expected to grow more than 130% through 2019.

Apache beat earnings estimates in the trailing four quarters, with an average of 31.1%.

Cactus’ earnings growth is projected at 13.5% through 2019.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ensco plc (ESV) : Free Stock Analysis Report

Apache Corporation (APA) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance