Energy to Post Strongest Earnings Growth in Q3: 5 Solid Picks

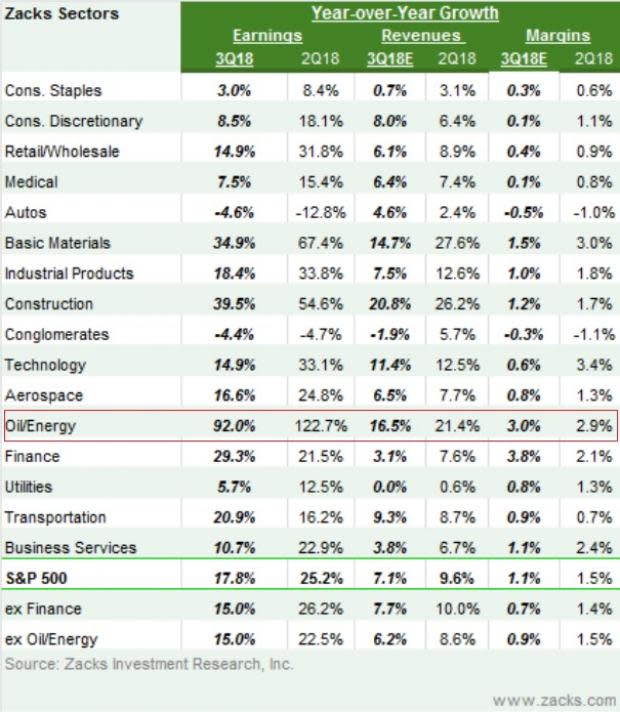

Healthier oil and natural gas prices have made the Energy sector an attractive investment opportunity. Our latest Earnings Trends shows that Energy will lead all Zacks Sectors to witness the strongest earnings growth in Q3.

Since, Energy is likely to see earnings growth of more than 90% in Q3 from the year-earlier quarter, investing in oil and gas explorers along with pipeline and storage service providers seems judicious.

Oil & Natural Gas Prices Strong in Q3

Per data provided by U.S. Energy Information Administration (EIA), the monthly average spot prices of West Texas Intermediate (WTI) crude for July, August and September of 2018 were recorded at $70.98 per barrel, $68.06 per barrel and $70.23 per barrel, respectively.

The average commodity prices were significantly higher than $46.63, $48.04 and $49.82 for the respective months of July, August and September of 2017. Traders mostly remained bullish on oil with optimism that United States is going to implement sanctions on crude export by Iran — the third-largest producer of oil among the OPEC member countries — on Nov 4.

Natural gas also fared well following improving clean energy demand. The average monthly spot prices of the commodity for the respective months of third-quarter 2018 were $2.83 per Million Btu, $2.96 per Million Btu and $3.00 per Million Btu — representing healthier prices than third-quarter 2017.

Energy to See Robust Earnings Growth

Energy is expected to report third-quarter 2018 earnings growth of 92%, the strongest among all 16 Zacks Sectors defining the S&P 500 index. In fact, excluding Energy, the year-over-year growth in earnings of the elite index through the July to September quarter of 2018 will likely drop to 15% from 17.8%.

Energy is projected to generate $20.7 billion earnings in third-quarter 2018, considerably higher than $17.5 billion, $15.6 billion, $11.2 billion and $10.8 billion reported in the respective past four quarters.

Which Energy Stocks to Bet On?

Healthier oil and gas prices act in favour of explorers and producers. Also, the strengthening commodity prices led energy players to produce record oil and gas volumes, boosting demand for pipeline and storage assets amid constrained domestic transportation capacities.

Hence, both upstream and midstream energy players are well positioned for strong Q3 numbers. However, choosing stocks with earnings beat potential might be a difficult task unless one knows the way to shortlist. One way to do this is to pick stocks that have the combination of a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP.

Earnings ESP is our proprietary methodology for identifying stocks that have high chances of surprising in their upcoming earnings announcements. It shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Our research shows that for stocks with this combination, the chance of a positive earnings surprise is as high as 70%.

Headquartered in Fort Worth, TX, Range Resources Corporation RRC is among the leading oil and gas producers.

The #2 Ranked firm,scheduled to report earnings results for the quarter ending September 2018 on Oct 23, has an Earnings ESP of +1.10%.

Headquartered in Denver, CO, Whiting Petroleum Corporation WLL is also a leading oil and gas producer.

The Zacks #2 Ranked firm is set to report Q3 earnings on Oct 30 and carries an Earnings ESP of +1.47%.

In terms of production and proved reserves, ConocoPhillips COP — headquartered in Houston, TX — is the largest oil and gas exploration and production player in the world.

The firm with a Zacks Rank of 2 is set to release Q3 earnings on Oct 25. It has an Earnings ESP of +1.31%.

Headquartered in Houston, TX, Occidental Petroleum Corporation OXY carries a Zacks Rank of 2.

The company, with exposure to both upstream and midstream operations, is scheduled to post Q3 results on Nov 5, 2018. Occidental currently has an Earnings ESP of +1.14%.

Headquartered in New York,Hess Corporation HES is primarily engaged in oil and gas exploration and productions.

The Zacks #2 Ranked firm, expected to post Q3 earnings on Oct 31, carries an Earnings ESP of +68.63%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Whiting Petroleum Corporation (WLL) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance