We need to end the fear-mongering about government debt in Australia

Remember when government debt was unsustainable?

The Liberal party sure as heck does because it has been their mantra for over a quarter of a century.

In 1997, Peter Costello told parliament about the “unsustainable debt position” inherited from Labor.

When the Rudd government embarked on its stimulus spending during the GFC, government debt again become unsustainable.

Barnaby Joyce, who was shadow finance minister at the time, while talking about “our net debt, gross, public and private” (a collection of words which economists even at this remove are still quite unable to untangle for signs of logic) argued that the debt level of 9% of GDP was “getting to a point where we can’t repay it”.

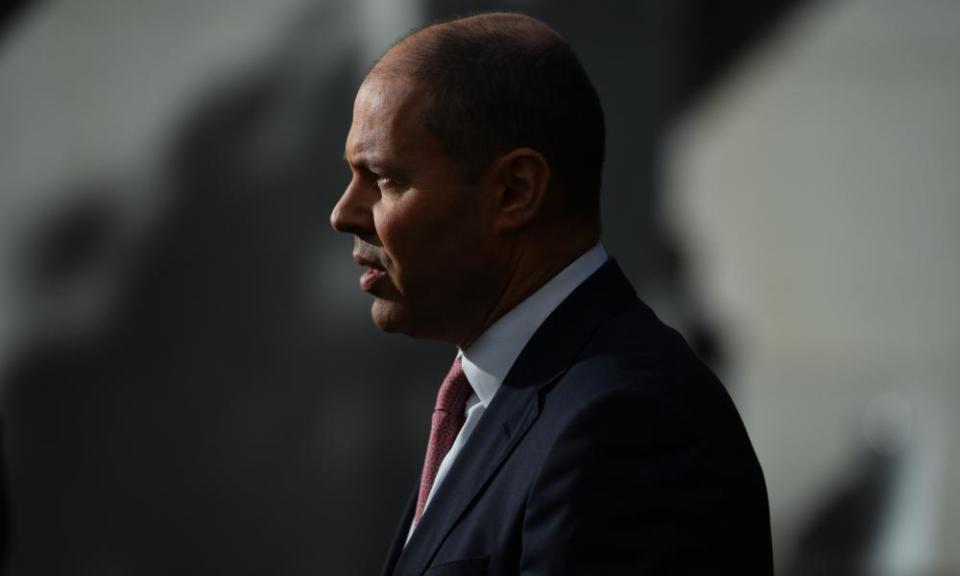

Related: ‘No pivots towards austerity’: budget to focus on jobs and economic recovery, Josh Frydenberg says

In 2011, then-Liberal backbencher Josh Frydenberg was establishing his Liberal party bona fides by suggesting “both the Rudd and Gillard governments have displayed their addiction to debt” and that “the messages for Australia are clear: ‘Big government is bad government’ and ‘Live within your means before it is too late.’ ”

Tony Abbott was the king of unsustainable debt fears.

In 2010 he talked about the NBN adding “billions and billions of dollars to Australia’s unsustainable debt”.

In 2014 he accused the ALP of thinking that governments can be “forever borrowing, spending, taxing, spending and running up unsustainable debt for our children and our grandchildren to repay” and for wanting “to saddle our children and our grandchildren with unsustainable debt.”

Truly, won’t someone think of the children (and the grandchildren).

Even Malcolm Turnbull got in on the act telling parliament in 2017 when prime minister: “What Labor delivered was unsustainable debt”.

So many words. Such a pity they were all bunk.

This week the Parliamentary Budget Office looked at fiscal sustainability out to 2055.

Graph not displaying? Click here

It estimated that government gross debt will hit likely 55% of GDP by the end of the decade and will still be above 30% of GDP – a rate nearly double anything observed since the second world war – by 2055.

And does the PBO conclude that this is the end for our children and grandchildren? Do they quickly need to invest in saddles?

Well, no.

The PBO ran 27 difference scenarios involving GDP growth, interest rates and the budget balance and concluded that “the government will be able to maintain a sustainable level of debt relative to GDP over the coming decades”.

It noted that “reducing the government debt-to-GDP ratio to pre-pandemic levels will take decades, even under relatively optimistic scenarios”.

But the issue is not particularly troubling because “debt servicing costs should remain subdued as the existing debt was borrowed at historically low interest rates”.

Indeed, the PBO estimates that when our gross debt level peaks in 2030, the annual interest repayment will be lower as a percentage of GDP than has been for all but 10 of the past 56 years.

And already we hear from Frydenberg that the budget (at least in 2021-22) will not focus on austerity, instead asserting that (quite correctly) the government has taken advantage of the current low interest rates by issuing 20 and 30 year bonds.

But sustainability is a curious phrase.

The PBO noted that “some challenges, such as the ageing population and climate change, are relatively foreseeable”, and yet the report does not include such aspects in its analysis.

The PBO asserts that “a fiscally sustainable position enables the private sector to make financial decisions with confidence about the direction of government policy.”

Yet the same can be said about our current unsustainable level of greenhouse gas emissions, but that is not considered.

It is as though the PBO estimates climate change will be somehow solved by the time 2055 rolls around.

In reality, the fraudulent fears of debt have been a large reason for the lack of “war-footing” spending required to transition our economy to net-zero emissions.

This report should cause political parties to abandon their fear-mongering and instead realise that our low interest rates should be used to transform our economy away from its reliance on greenhouse gas emissions.

Our government finances are sustainable, but without fully ending the fear of debt, our economy will never be so.

Yahoo Finance

Yahoo Finance