Emerson (EMR) Q2 Earnings Beat, Revenues Rise 14% Y/Y

Emerson Electric Co. EMR reported second-quarter fiscal 2023 (ended Mar 31, 2023) adjusted earnings of $1.09 per share, which beat the Zacks Consensus Estimate of 97 cents. Our estimate for fiscal second-quarter adjusted earnings was 96 cents per share. The bottom line declined 15.5% in the reported quarter.

Emerson’s net sales of $3,756 million beat the Zacks Consensus Estimate of $3,650 million. This compared favorably with our estimate of $3,636.6 million. The top line increased 14% year over year. Underlying sales were up 14% as well.

Segmental Details

Effective from the fiscal first quarter of 2023, the company started reporting under two segments, namely Intelligent Devices, and Software and Control Automation Solutions.

The Intelligent Devices segments’ net sales came in at $2,924 million, increasing 10% year over year. Our estimate for segmental revenues was $2,816.9 million. The segment consists of four subgroups, namely Final Control, Measurement & Analytical, Discrete Automation, and Safety & Productivity. Final Control’s revenues increased to $992 million from $884 million in the second quarter of fiscal 2023. Measurement & Analytical generated revenues of $888 million, up from $769 million in the second quarter of fiscal 2023. Discrete Automation’s revenues totaled $683 million compared with the $644 million reported in the year-ago quarter. Safety & Productivity’s revenues increased to $361 million from $355 million in the second quarter of fiscal 2023.

The Software and Control Automation Solutions segment generated net sales of $853 million in the fiscal second quarter, up 30% year over year. Our estimate for segmental revenues was $841.2 million. The segment consists of two subgroups, namely Control Systems & Software, and AspenTech. Control Systems & Software reported revenues of $623 million compared with $573 million in the year-ago quarter. AspenTech generated net sales of $230 million, up 172% year over year.

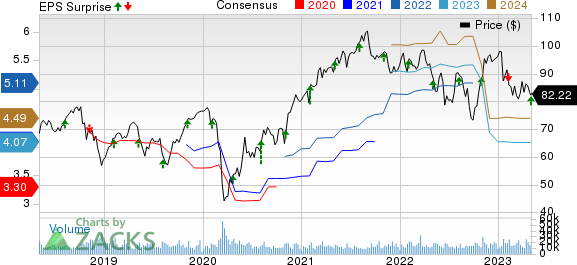

Emerson Electric Co. Price, Consensus and EPS Surprise

Emerson Electric Co. price-consensus-eps-surprise-chart | Emerson Electric Co. Quote

Margin Details

In the quarter under review, Emerson's cost of sales increased 7.7% year over year to $1,955 million. The pretax margin in the quarter was 17% compared with 15.5% in the year-ago period. The adjusted EBITA margin came in at 23.3% compared with 19.8% in the year-ago quarter. Selling, general and administrative expenses increased 12.6% to $1,000 million.

Balance Sheet and Cash Flow

Exiting second-quarter fiscal 2023, Emerson had cash and cash equivalents of $2,046 million compared with $6,929 million in the year-ago quarter. Long-term debt was $8,174 million compared with $8,203 million in the year-ago period. In the first six months of fiscal 2023, the company repaid debts of $742 million.

In the same time period, the company generated net cash of $486 million from operating activities, reflecting a decrease of 49.6% from the year-ago period. Capital expenditure was $121 million, down from $140 million in the year-ago period.

The company paid out dividends of $603 million and repurchased common stocks worth $2000 million in the same period.

FY23 & Q3 Outlook

Emerson anticipates year-over-year net sales growth of 9-10.5% in fiscal 2023 compared with 8-10% stated earlier. Underlying sales are expected to rise 8.5-10% in the year.

EMR anticipates earnings per share of $3.58-$3.68 for fiscal 2023 compared with $3.55-$3.70 mentioed earlier. Adjusted earnings per share are estimated to be $4.15-$4.25.

For the third quarter of fiscal 2023, Emerson anticipates year-over-year net sales growth of 10.5-12.5% and underlying sales growth of 10-12%. Adjusted earnings per share is anticipated to be $1.07-$1.00.

Zacks Rank & Stocks to Consider

EMR currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Ingersoll Rand Inc. IR presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

IR’s earnings surprise in the last four quarters was 8.5%, on average. In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 3.3%. The stock has rallied 11.1% in the past six months.

Parker-Hannifin Corporation PH currently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 9.1%, on average.

In the past 60 days, estimates for Parker-Hannifin’s fiscal 2023 (ending June 2023) earnings have increased 0.5%. The stock has gained 13.6% in the past six months.

Allegion plc ALLE presently carries a Zacks Rank of 2. ALLE’s earnings surprise in the last four quarters was 12.5%, on average.

In the past 60 days, Allegion’s earnings estimates have increased 4.1% for 2023. The stock has gained 7.1% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Parker-Hannifin Corporation (PH) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance