Education Department removed tool for defrauded students 9 days after launch

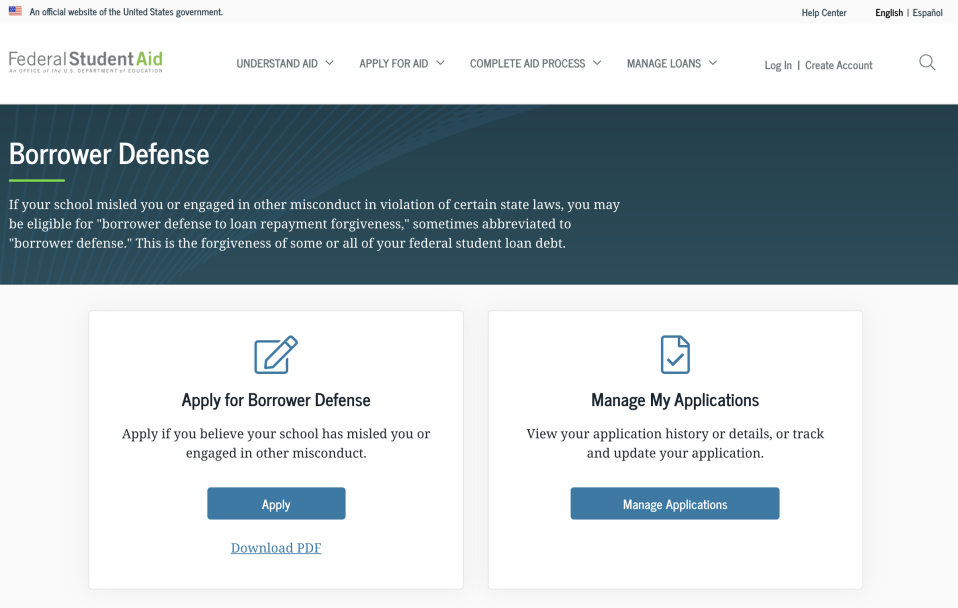

On Nov. 10, the Department of Education (ED) launched a fresh website to help borrowers who are seeking debt relief after being defrauded by a college.

The new website attempted to improve the borrower defense process, which is a fairly complicated process that involves former students of allegedly predatory schools seeking loan forgiveness.

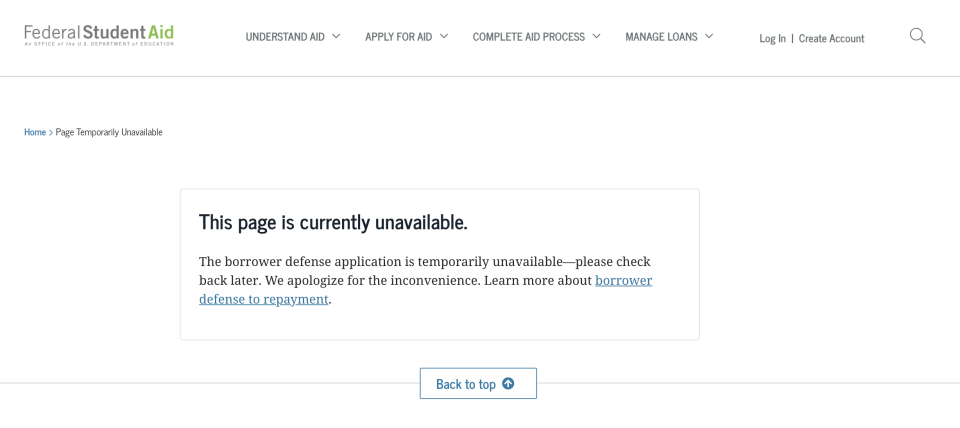

On Nov. 19, that website was taken down.

“We are troubled that the Department of Education removed a new web tool from its website that was designed to help students who have been defrauded,” Reps. Bobby Scott, Chairman of the Committee on Education and Labor, and Carolyn Maloney, Chairwoman of the Committee on Oversight and Reform, said in a statement.

Politico reported that the ED was forced to walk back its tool because they had not obtained the required approval from the Office of Management and Budget (OMB), which is required by the Paperwork Reduction Act. ED has not responded to a request for comment from Yahoo Finance.

Reps. Scott and Maloney refused to accept this reason.

“Once again, the Department’s public explanations do not hold water, and it now appears that the White House may be interfering in this process,” they stated. “The Department should immediately put the tool back online and stop its continued and repeated efforts to undermine the Borrower Defense program.”

‘I know this is disappointing’

Borrower defense rules were originally written into law through the Higher Education Act in the early 1990s and were meant to help victims of fraudulent schools seek relief.

Under existing law, borrowers with federal loans are eligible for loan forgiveness if a college or a university has misled them or engaged in other misconduct in violation of certain state laws.

After the Great Recession, enrollment at for-profit schools “skyrocketed in the first decade of the period, nearly quadrupling between 2000 and 2011,” according to the New York Fed.

The Obama administration instituted regulations protecting defrauded borrowers, and the Trump administration attempted to dismantle those regulations despite court rulings favoring borrowers.

President-elect Biden’s administration is expected to bring those regulations back.

The now-shuttered website incidentally faced its second death: It’s the same tool that the department had paused a few months back, which led to an investigation by the House Education Committee.

A whistleblower complaint, discovered by a U.S. News reporter in June, alleged that the principal deputy undersecretary at the FSA had pushed back on changes that made the site more user-friendly.

In October, the education committee revealed documents in which they said showed how that played out.

“I know this is disappointing,” an FSA official wrote in an email, “as many of us have done a lot of work to get to this point.”

—

Aarthi is a reporter for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

Trump v. Biden: Here's what's at stake for student loan borrowers

'Just not right': Defrauded for-profit college students suffer rejected relief claims

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance