Economists split on whether Fed policy is 'quantitative easing'

A panel of business economists are unsure if the Federal Reserve’s purchases of short-term Treasury bills are akin to the central bank’s crisis-era policy of large-scale asset purchases in a policy known as “quantitative easing.”

Most economists said the markets are agnostic to whether its balance sheet expansion is truly quantitative easing.

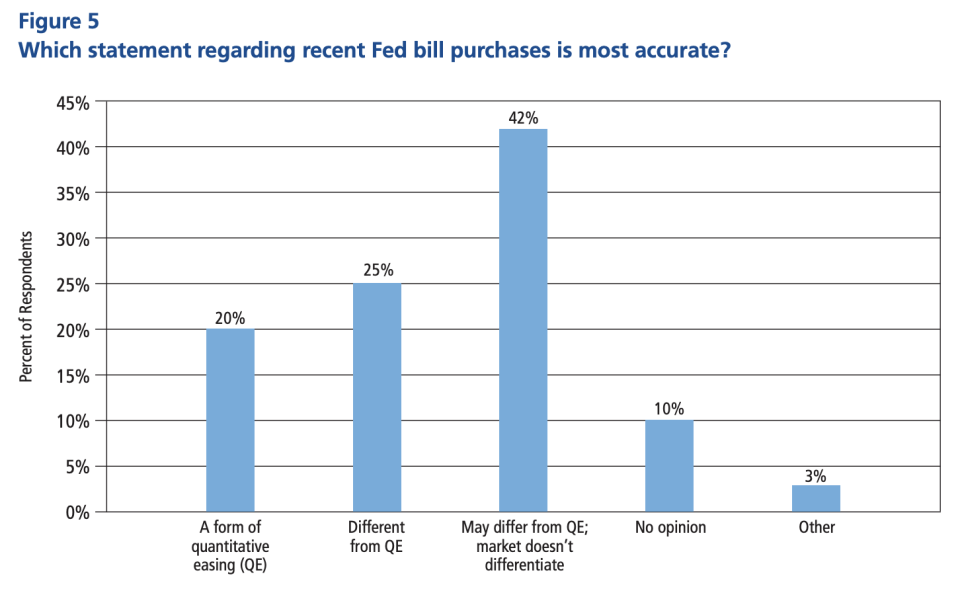

The National Association for Business Economics surveyed 210 of its economists and reported Monday that 42% of respondents said the Fed’s policy “may differ” from quantitative easing, but said markets do not “differentiate” if the action is QE or not.

By contrast, about 20% of the respondents said the Fed’s $60-billion-a-month pace of T-bill purchases are a form of quantitative easing, while 25% said the purchases are “different from QE.”

The action in question concerns the Fed’s efforts to ease conditions in money markets, perceived to be the “plumbing” of the financial system.

In September of last year, interest rates on overnight borrowing spiked well above the Fed’s target range as policymakers realized that the Fed’s balance sheet unwind left too few reserves in the banking system.

The Fed reversed course in October by announcing that it would be buying assets again, this time targeting short-term T-bills at a pace of about $60 billion per month.

The Fed also committed to offering its own repo facilities out of its New York location.

The central bank made a concerted effort to clarify that the asset purchases are not like its crisis-era initiative of large-scale asset purchases of longer-term assets for the explicit purpose of lowering longer-term yields and absorbing the risk of mortgage-backed securities.

“These are very important operational matters but are not likely to have any macroeconomic implications,” Fed Chair Jerome Powell said in December.

The Fed has said it would continue its T-bill purchases through the second quarter of this year and provide temporary repo operations out of the New York Fed at least through April.

On interest rate policy, the NABE appeared to be pleased with the Fed’s efforts to steer clear of a recession.

Last year, the Federal Open Market Committee cut rates three times for a total of 75 basis points. At the time, the Fed cited concerns over trade policies and geopolitical tension, adding that inflation was running below its 2% target.

Almost two-thirds, or 63%, of the surveyed NABE members said the Fed now has monetary policy right for the U.S. economy.

The Fed’s next policy-setting decision is scheduled for March 18.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed ponders financial market impacts as it considers new tools

Morgan Stanley, E-Trade merger underscores race for scale in financial services

Dallas Fed's Kaplan: US economy 'likely at or past' full employment

'This is the new normal': California businesses pessimistic on phase 2 deal

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance