Eaton's (ETN) Q3 Earnings Beat, Revenues Miss, View Cut

Eaton Corporation ETN reported third-quarter 2019 earnings of $1.52 per share, which surpassed the Zacks Consensus Estimate by a penny. The reported earnings were at the lower end of management’s guided range of $1.50-$1.60 per share. Moreover, the bottom line marked a 6% improvement from the year-ago level.

GAAP earnings in the reported quarter were $1.44 per share compared with 96 cents in the year-ago period. The difference between GAAP and operating earnings in the reported quarter was due to one-time acquisition and divestiture transaction and integration costs.

Revenues

Total revenues in the quarter came in at $5,314 million, lagging the Zacks Consensus Estimate of $5,545 million by 4.2%. Quarterly revenues also decreased 1.8% from the year-ago quarter.

The year-over-year decline in revenues was due to 1% fall in organic sales and negative currency translation of 1.5%. These negatives were partially offset by gains from acquired assets.

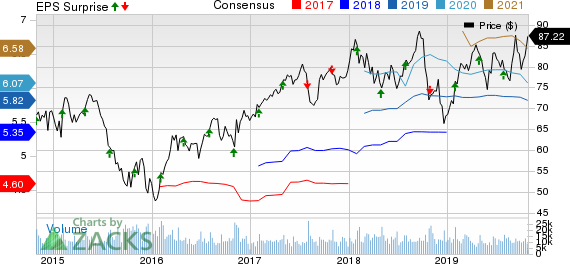

Eaton Corporation, PLC Price, Consensus and EPS Surprise

Eaton Corporation, PLC price-consensus-eps-surprise-chart | Eaton Corporation, PLC Quote

Segment Details

Electrical Products’ total third-quarter sales were $1,786 million, down 0.2% from the year-ago level. Although organic sales were up 1% from the prior-year quarter, the metric was negatively impacted by 1% due to currency translation.

Electrical Systems and Services’ total sales were $1,572 million, up 3.5% from the year-ago quarter. Organic sales were also up 3% from the year-ago quarter. The acquisition of Ulusoy and Innovative Switchgear added 1.5% to its sales, which were negatively impacted by 1.5% due to currency translation.

Hydraulics total sales were $603 million, down 10% from the year-ago quarter. Organic sales were down 8% year over year and negative currency translation adversely impacted revenues by another 2%.

Aerospace total sales were $513 million, up 7.3% from the year-ago quarter due to 8% organic sales growth, marginally offset by negative currency translation of 1%.

Vehicle total sales were $761 million, down 13.1% from the year-ago quarter, owing to a 12% decline in organic sales and 1% negative currency translation.

eMobility segment’s total sales were $79 million, down 1.2% from the year-ago quarter. Organic sales were flat with the prior-year level. Revenues were negatively impacted by 1% due to currency translation.

Quarterly Highlights

Segment margins in the reported quarter were 18.7%, up 110 basis points (bps) from the year-ago level.

Cost of products sold in the reported quarter was $3,512 million, down 2.4% from the year-ago figure.

Selling and administrative expenses were $885 million, down 0.5% from the year-ago quarter.

The company’s research and development expenses in the first nine months of the year were $454 million, up 3.4% from the prior-year period. Interest expenses in the first nine months of 2019 were $183 million, down 10.7% from the comparable prior-year period.

Orders in Electrical Products (excluding Lighting), Electrical Systems and Services, and Aerospace were up 1%, 5% and 13% year over year, respectively. On the contrary, Hydraulics’ orders were down 14% year over year due to weakness in the global mobile equipment market.

It repurchased shares worth $539 million in the quarter, resulting in a repurchase of $949 million shares year to date.

Financial Update

Eaton’s cash & cash equivalents were $549 million as of Sep 30, 2019 compared with $283 million on Dec 31, 2018.

As of Sep 30, 2019, long-term debt of the company was $8,013 million, up from $6,768 million on Dec 31, 2018.

Guidance

Fourth-quarter 2019 earnings per share are expected between $1.36 and $1.46.

The company now expects 2019 earnings within $5.67-$5.77, down from the prior guided range of $5.77-$5.97 per share. Segment operating margin for 2019 is expected within 17.3-17.7%.

Eaton has plans to repurchase shares worth $1 billion in 2019. Currency translation is likely to have a negative impact of $350 million in 2019.

The company expects organic revenues to improve 1% in 2019, down 200 bps from the prior expectation.

Zacks Rank

Currently, Eaton has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Regal Beloit Corporation RBC is slated to announce third-quarter 2019 earnings on Nov 4. The Zacks Consensus Estimate for the quarter to be reported is pegged at $1.33.

Emerson Electric Co. EMR is slated to announce fourth-quarter fiscal 2019 earnings on Nov 5. The Zacks Consensus Estimate for the quarter is pegged at $1.07.

Enersys ENS is scheduled to report fiscal second-quarter 2020 earnings on Nov6. The Zacks Consensus Estimate for the to-be-reported quarter is pegged at $1.20.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Regal Beloit Corporation (RBC) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance