Eaton Vance (EV) Q1 Earnings Meet Estimates, Revenues Rise

Eaton Vance Corp.’s EV first-quarter fiscal 2020 (ended Jan 31) adjusted earnings of 86 cents per share were in line with the Zacks Consensus Estimate. The bottom line increased 17.8% year over year.

Results were driven by an improvement in assets under management (AUM) balance and rise in revenues. However, higher operating expenses acted as a headwind.

Net income attributable to shareholders (GAAP basis) was $104 million, up 19.8% from the year-ago quarter.

Revenues Improve, Expenses Rise

Total revenues were $452.6 million, up 11.4% year over year. Rise in management fees and service fees drove the increase. The top line surpassed the Zacks Consensus Estimate of $442.3 million.

Total expenses increased 11.4% from the prior-year quarter to $317.8 million due to a rise in all expense components.

Total operating income increased 11.2% year over year to $134.7 million.

Liquidity Position Strong, AUM Balance Improves

As of Jan 31, 2020, Eaton Vance had $544.1 million in cash and cash equivalents compared with $557.7 million as of Oct 31, 2019. The company had no borrowings outstanding against its $300-million credit facility.

Eaton Vance’s consolidated AUM grew 16.5% year over year to $518.2 billion as of Jan 31, 2020. Net inflows and market price appreciation drove the rise.

Share Repurchase Update

During the quarter, the company repurchased and retired 1.4 million shares of its Non-Voting Common Stock for $66.6 million under its existing repurchase authorization.

Our Take

Eaton Vance’s improving AUM balance and higher revenues are likely to support growth in the quarters ahead. However, increasing expenses might hamper its bottom line to an extent.

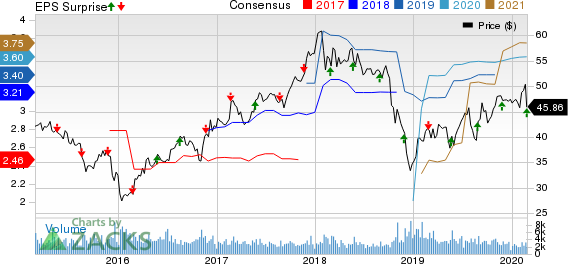

Eaton Vance Corporation Price, Consensus and EPS Surprise

Eaton Vance Corporation price-consensus-eps-surprise-chart | Eaton Vance Corporation Quote

Currently, the company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Managers

BlackRock’s BLK fourth-quarter 2019 adjusted earnings of $8.34 per share surpassed the Zacks Consensus Estimate of $7.67. Moreover, the figure was 37.2% higher than the year-ago quarter’s number.

Cohen & Steers’ CNS fourth-quarter 2019 adjusted earnings of 74 cents per share surpassed the Zacks Consensus Estimate of 67 cents. Also, the bottom line was 32.1% higher than the year-ago quarter figure.

Invesco IVZ reported fourth-quarter 2019 adjusted earnings of 64 cents per share, missing the Zacks Consensus Estimate of 70 cents. However, the bottom line rose 45.5% from the prior-year quarter.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Eaton Vance Corporation (EV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance