Easy Come, Easy Go: How Scorpio Bulkers (NYSE:SALT) Shareholders Got Unlucky And Saw 92% Of Their Cash Evaporate

It is a pleasure to report that the Scorpio Bulkers Inc. (NYSE:SALT) is up 52% in the last quarter. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Indeed, the share price is down a whopping 92% in that time. So we don't gain too much confidence from the recent recovery. The important question is if the business itself justifies a higher share price in the long term.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Scorpio Bulkers

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

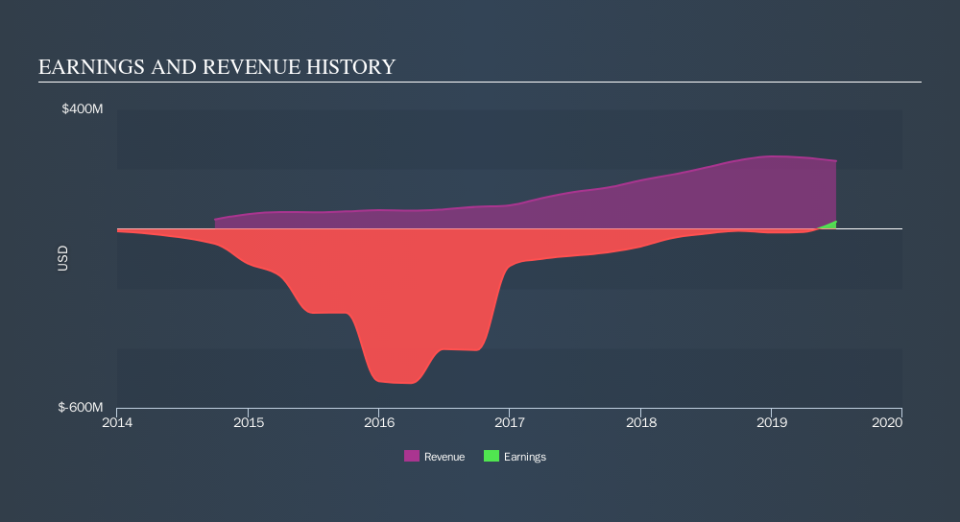

During five years of share price growth, Scorpio Bulkers moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

The modest 1.2% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 39% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Scorpio Bulkers has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Scorpio Bulkers's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Scorpio Bulkers's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Scorpio Bulkers's TSR, which was a 91% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Scorpio Bulkers shareholders gained a total return of 1.0% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 39% endured over half a decade. It could well be that the business is stabilizing. Before deciding if you like the current share price, check how Scorpio Bulkers scores on these 3 valuation metrics.

We will like Scorpio Bulkers better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance