Easy Come, Easy Go: How eQube Gaming (CVE:EQG) Shareholders Got Unlucky And Saw 84% Of Their Cash Evaporate

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held eQube Gaming Limited (CVE:EQG) for five whole years - as the share price tanked 84%. On top of that, the share price is down 43% in the last week.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for eQube Gaming

eQube Gaming wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

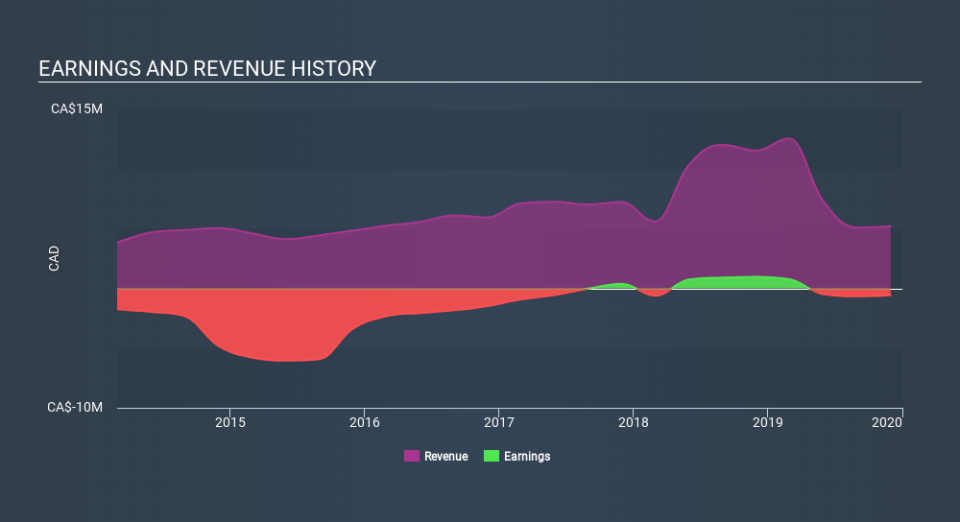

In the last half decade, eQube Gaming saw its revenue increase by 14% per year. That's a pretty good rate for a long time period. So the stock price fall of 31% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on eQube Gaming's earnings, revenue and cash flow.

A Different Perspective

While it's never nice to take a loss, eQube Gaming shareholders can take comfort that their trailing twelve month loss of 20% wasn't as bad as the market loss of around 25%. Of far more concern is the 31% p.a. loss served to shareholders over the last five years. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that eQube Gaming is showing 4 warning signs in our investment analysis , and 2 of those are significant...

But note: eQube Gaming may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance