Easy Come, Easy Go: How Chemours (NYSE:CC) Shareholders Got Unlucky And Saw 76% Of Their Cash Evaporate

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held The Chemours Company (NYSE:CC) during the last year don't lose the lesson, in addition to the 76% hit to the value of their shares. A loss like this is a stark reminder that portfolio diversification is important. Even if you look out three years, the returns are still disappointing, with the share price down74% in that time. Furthermore, it's down 45% in about a quarter. That's not much fun for holders.

View our latest analysis for Chemours

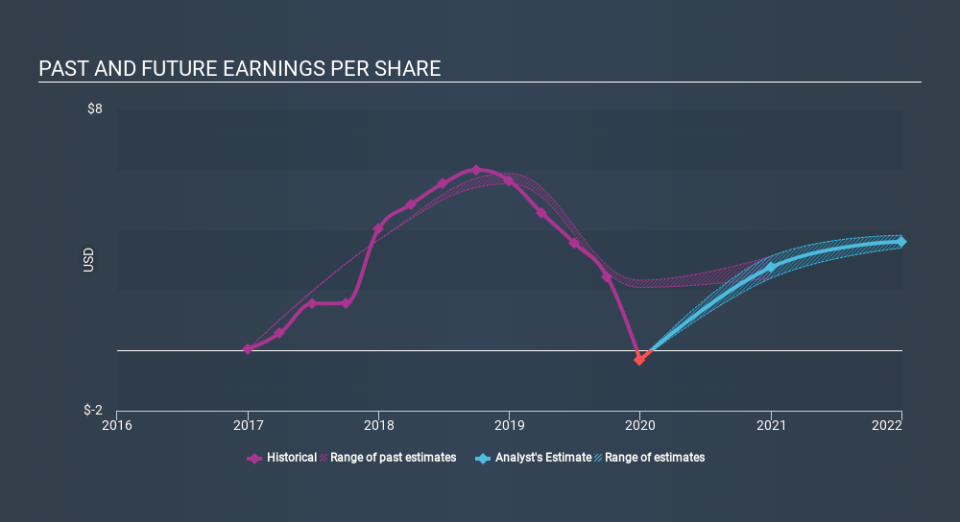

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Chemours saw its earnings per share drop below zero. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. Of course, if the company can turn the situation around, investors will likely profit.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on Chemours's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Chemours's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Chemours shareholders, and that cash payout explains why its total shareholder loss of 74%, over the last year, isn't as bad as the share price return.

A Different Perspective

Chemours shareholders are down 74% for the year (even including dividends) , falling short of the market return. Meanwhile, the broader market slid about 6.2%, likely weighing on the stock. The three-year loss of 34% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Chemours better, we need to consider many other factors. Take risks, for example - Chemours has 3 warning signs (and 1 which is potentially serious) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance