Eastman Chemical (EMN) Announces Hike in Quarterly Dividend

Eastman Chemical Company EMN announced that its board declared a quarterly cash dividend on its common stock of 66 cents per share, reflecting a 6.5% increase from the prior payout of 62 cents per share.

Notably, the company hiked its dividend for the tenth consecutive year. This is consistent with its focus on disciplined and balanced capital allocation, and shareholders’ returns.

The revised dividend will be payable Jan 3, 2020, to shareholders of record as of Dec 16, 2019.

Per management, the dividend hike reflects the company’s capacity to generate strong cash flow and deliver earnings growth.

Eastman Chemical’s shares have gained 6% year to date, outperforming an 18.3% decline of the industry it belongs to.

The company ended the third quarter with cash and cash equivalents of $207 million, up around 7% year over year. Net debt at the end of the third quarter was $6,002 million, down around 7% year over year.

Moreover, Eastman Chemical generated cash from operating activities of $416 million and free cash flow of $306 million in the third quarter. The company returned $160 million to shareholders through share repurchases and dividends in the third quarter.

Eastman Chemical anticipates sales volume and capacity utilization to decline in the fourth quarter due to the worsening of the global business environment, resulting from trade uncertainties and other macro factors. Considering the factors, the company anticipates adjusted earnings per share of $7.00-$7.20 for 2019.

Amid the difficult business environment, it remains focused on managing costs and growing new business revenues from innovation, especially in the Advanced Materials segment.

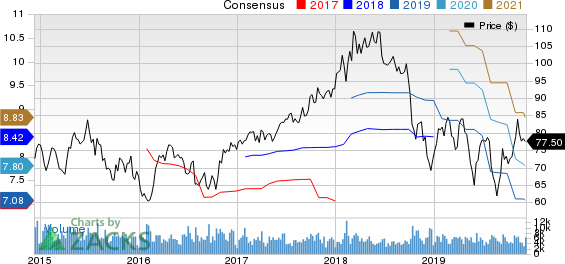

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Zacks Rank & Stocks to Consider

Eastman Chemical currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are General Moly, Inc GMO, Franco-Nevada Corporation FNV and Agnico Eagle Mines Limited AEM, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

General Moly has an expected earnings growth rate of 12.5% for the current fiscal year. The company’s shares have gained 34% in the past year.

Franco-Nevada has a projected earnings growth rate of 45.3% for 2019. The company’s shares have rallied 36.3% in a year.

Agnico Eagle has an estimated earnings growth rate of 167.9% for the current year. Its shares have moved up 53.8% in the past year.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

General Moly, Inc (GMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance