E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – August 19, 2019 Forecast

September E-mini Dow Jones Industrial Average futures are trading higher shortly after the opening on Monday. Most of the move took place in the pre-market session due to strong rallies in Asia and Europe. It looks like U.S. investors are a little reluctant to buy strength in the wake of recent volatility.

At 14:46 GMT, September E-mini Dow Jones Industrial Average futures are at 26131, up 224 or +0.87%.

The early rally is being underpinned by an easing of worries over a U.S. recession. Traders are also reacting to reports of additional stimulus plans by the Chinese government and the European Central Bank (ECB).

Daily Technical Analysis

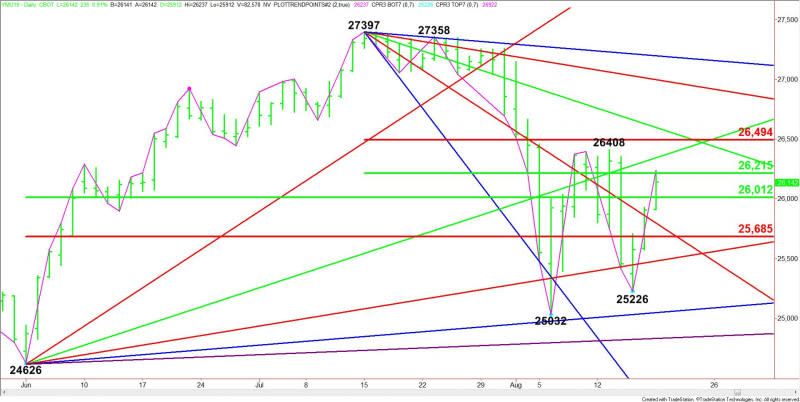

The main trend is down according to the daily swing chart. However, momentum is trending higher because of the pair of closing price reversal bottoms at 25226 and 25032. Both prices are also secondary higher bottoms.

The main trend will change to up on a trade through 26408. A move through 25226 will signal a resumption of the downtrend.

The main range is 24626 to 27397. Its retracement zone at 26012 to 25685 is controlling the near-term direction of the index. It is also a support area.

The minor range is 27397 to 25032. Its retracement zone at 26215 to 26494 is resistance. It stopped a rally at 26408 on August 13. Taking out this zone will put the index in a position to challenge the main top at 27397.

Daily Technical Forecast

Based on the early price action, the direction of the September E-mini S&P 500 Index the rest of the session on Monday is likely to be determined by trader reaction to the short-term 50% level at 26215.

Bullish Scenario

A sustained move over 26215 will indicate the presence of buyers. This could trigger a rally into an uptrending Gann angle at 26354. Overcoming this angle will put the Dow in a position to challenge the main top at 26408.

Taking out 26408 will change the main trend to up. This should lead to a quick test of the short-term Fibonacci level at 26494. This is followed closely by a downtrending Gann angle at 26597.

Bearish Scenario

A sustained move under 26215 will signal the presence of sellers. This could trigger a pullback into the main 50% level at 26012.

The daily chart opens up to the downside under 26012 with the next major target the main Fibonacci level at 25685.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance