DXC & ServiceNow Expands Partnership on Enterprise Services

DXC Technology DXC recently announced that it is forming a new global DXC ServiceNow Strategic Business Group in collaboration with ServiceNow NOW to advance the transformation of enterprise operational services.

Through this alliance, DXC intends to offer cost-efficient and resilient technology services, built on its data-driven intelligent automation solution, Platform X, to enterprises to automate their service operations and meet customer requirements. The company has selected ServiceNow as its preferred workflow partner for Platform X.

DXC Platform X enables information technology (“IT”) professionals to detect and resolve abiding system lags quickly while automatically predicting and mitigating future business problems. This platform helps the company optimize by reducing costs and offering immediate benefits for future operational models, thus, helping enterprise customers achieve a state of ‘silent operations.’

DXC claims that this modernization approach will drive greater operational resilience and accelerate enterprise transformation by delivering better employee and customer experiences and increasing returns on investment.

Teaming up with ServiceNow and providing its Platform X solutions, DXC aims to become a leader in enterprise service management, expanding its global reach in the days ahead. The company is focusing on partnerships to enhance its offerings. It is digging deep to expand its networking-based infrastructure with the benefits of VMware’s hybrid cloud offerings, which aided it in strengthening its position in the virtualization server market.

Besides, DXC is in partnership with Amazon to develop cloud-based solutions for enterprise and public sector clients. We believe the company’s focus on entering into strategic partnerships will help it expand in the cloud computing space and garner additional revenues.

Currently, the company is focusing on the cloud computing market, cyber business and Big Data business. Clients are increasingly relying on cloud-based services as DXC makes the IT system more agile and productive, which leads to considerable cost savings. However, the segment is still underpenetrated.

Per Gartner, worldwide IT spending is anticipated to be $4.5 trillion in 2022, suggesting an increase of 5.1% from 2021. The research firm expects worldwide spending on IT services to grow 7.9% year over year to $1.28 trillion this year. Therefore, DXC, being a major player in the space, is anticipated to benefit from this untapped opportunity.

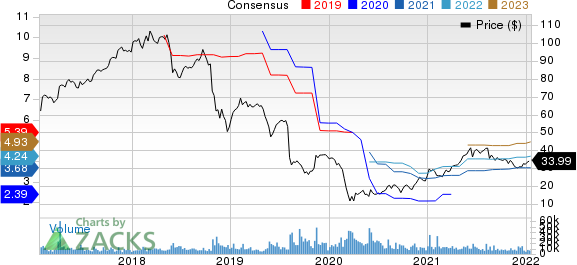

DXC Technology Company. Price and Consensus

DXC Technology Company. price-consensus-chart | DXC Technology Company. Quote

Zacks Rank & Stocks to Consider

DXC currently carries a Zacks Rank #3 (Hold) while ServiceNow has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the broader computer and technology sector include the largest global Customer Relationship Management vendor Salesforce CRM and Hewlett Packard HPE, both flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Salesforce’s fourth-quarter fiscal 2022 earnings has been revised downward by 7.6% to 73 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved upward by 0.43% to $4.68 per share in the last 60 days.

Salesforce’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 44.2%. CRM stock has depreciated 1.2% in the past year.

The Zacks Consensus Estimate for HPE’s first-quarter fiscal 2022 earnings has been revised downward by 6.1% to 46 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved north by 1.5% to $2.03 per share in the past 90 days.

HPE’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14.4%. Shares of HPE have rallied 37.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

DXC Technology Company. (DXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance