Duke Energy (DUK) Q4 Earnings Beat, Revenues Decline Y/Y

Duke Energy Corporation DUK reported fourth-quarter 2020 adjusted earnings of $1.03 per share, which surpassed the Zacks Consensus Estimate of $1.02 by 1%. The bottom line also improved 13.2% year over year, driven by increased investments in electric and gas utilities and new renewable projects placed in service.

Including one-time adjustments, the company reported GAAP losses of 12 cents per share against the year-ago quarter’s GAAP earnings of 88 cents.

For 2020, the company recorded adjusted earnings of $5.12 per share, which surpassed the Zacks Consensus Estimate of $5.10 by 0.4%. The bottom line also improved 1.2% from the prior year.

Total Revenues

Total operating revenues came in at $5,777 million, which dropped 5.3% from $6,103 million a year ago. The reported figure also missed the Zacks Consensus Estimate of $6,222 million by 7.1%.

In 2020, the company recorded revenues of $23.87 billion, down 4.8% from $25.08 billion a year ago. The full-year figure missed the Zacks Consensus Estimate of $24.31 million by 1.8%.

The Regulated electric unit’s revenues were $5,059 million (down 6.2% year over year), representing 87.6% of total revenues in the quarter.

Revenues from the regulated natural gas business totaled $527 million, down 0.2% year over year.

The Non-regulated Electric and Other segment generated revenues of $191 million, which improved 4.4% year over year.

Operational Update

Duke Energy’s total operating expenses amounted to $5,703 million in the reported quarter, up 14.3% year over year. The escalation was on account of higher impairment charges, increased depreciation and amortization, and escalated property and other taxes.

Operating income plunged 93.3% to $74 million from $1,109 million in the year-ago quarter.

Interest expenses fell to $535 million from $547 million in fourth-quarter 2019.

Segmental Highlights

Electric Utilities & Infrastructure: Adjusted income in the fourth quarter totaled $675 million, which was higher than $584 million reported in the year-ago quarter.

Gas Utilities & Infrastructure: Adjusted income in this segment totaled $150 million, down from $159 million a year ago.

Commercial Renewables: This segment witnessed an adjusted income of $79 million in the quarter under review compared with $59 million in the year-ago quarter.

Other: The segment includes corporate interest expenses not allocated to other business units, resulting from Duke Energy’s captive insurance company and other investments.

This segment incurred an adjusted loss of $127 million compared with a loss of $124 million in the year-ago quarter.

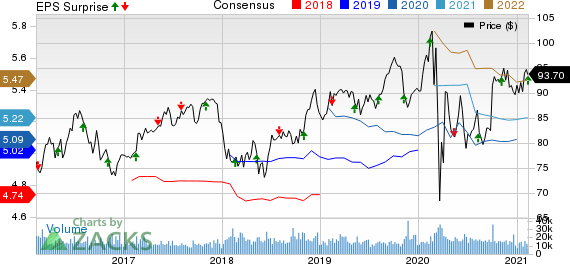

Duke Energy Corporation Price, Consensus and EPS Surprise

Duke Energy Corporation price-consensus-eps-surprise-chart | Duke Energy Corporation Quote

Financial Condition

As of Dec 31, 2020, Duke Energy had cash & cash equivalents of $259 million, down from $311 million as of Dec 31, 2019. Long-term debt was $55.63 billion at the end of 2020 compared with $54.99 billion at 2019-end.

In 2020, the company generated net cash from operating activities of $8.86 billion compared with $8.21 billion in 2019.

Guidance

Duke Energy issued its 2021 adjusted EPS guidance. It expects adjusted earnings per share of $5.00-$5.30. The Zacks Consensus Estimate for 2021 earnings is pegged at $5.22 per share, above the midpoint of the company’s projected range.

Zacks Rank

Duke Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

Xcel Energy Inc. XEL posted fourth-quarter 2020 operating earnings of 54 cents per share, in line with the Zacks Consensus Estimate.

NextEra Energy, Inc. NEE reported fourth-quarter 2020 adjusted earnings of 40 cents per share, which beat the Zacks Consensus Estimate of 39 cents by 2.6%.

CMS Energy Corporation CMS reported fourth-quarter 2020 adjusted earnings per share of 56 cents, which surpassed the Zacks Consensus Estimate of 55 cents by 1.8%.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance