Dril-Quip (DRQ) Stock Gains 2.1% Despite Q1 Earnings Miss

Dril-Quip Inc. DRQ shares have gained 2.1% despite reporting lower-than-expected first-quarter 2022 results on Apr 28. The manufacturer of highly engineered drilling and production equipment expects a continuous improvement in the business scenario in the near future. The company’s strong balance sheet, with ample liquidity, has been appreciated by investors.

Dril-Quip reported a first-quarter 2022 adjusted loss per share of 29 cents, wider than the Zacks Consensus Estimate of a loss of 21 cents. However, the bottom line improved from the year-ago loss of 47 cents per share.

The company registered total quarterly revenues of $83 million, missing the Zacks Consensus Estimate of $90 million. The top line increased from the year-ago quarter’s $81 million.

The lower-than-expected results can be attributed to the higher cost of sales. The negatives were partially offset by an increase in product revenues as a result of higher subsea product volumes.

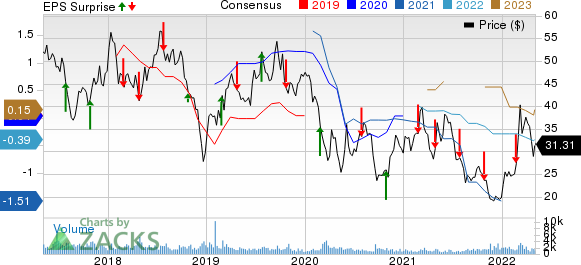

DrilQuip, Inc. Price, Consensus and EPS Surprise

DrilQuip, Inc. price-consensus-eps-surprise-chart | DrilQuip, Inc. Quote

Q1 Performance

Dril-Quip reported product bookings of $66.5 million for the quarter. At the first quarter-end, it had $220.9 million in the backlog.

The company reported a first-quarter operating loss of $5.6 million, narrower than a loss of $31.6 million in the prior-year period.

Total Costs and Expenses

On the cost front, the cost of sales increased to $64 million for the reported quarter from $56.8 million in the year-ago period. However, engineering and product development costs contracted to $3.7 million for the quarter from the year-ago figure of $4 million. SG&A costs declined to $22.4 million from $29.6 million a year ago.

Total costs and expenses for the quarter were $88.7 million compared with $112.8 million a year ago.

Free Cash Flow

In the first quarter, Dril-Quip generated a negative free cash flow of $13 million against a cash flow of $10.6 million a year ago.

Financials

Dril-Quip recorded $2.1 million in capital expenditure for the quarter versus the year-ago level of $2.5 million.

As of Mar 31, 2022, its cash balance was $338 million. The company’s balance sheet is free of debt load, which highlights a sound financial position.

Guidance

For 2022, Dril-Quip revised its expectation of product bookings upward to $60-$80 million from the prior projection of $40-$60 million.

The Zacks Rank #3 (Hold) company projects total capital expenditure of $15-$17 million for the year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

BP plc BP reported first-quarter 2022 adjusted earnings of $1.92 per American Depositary Share on a replacement-cost basis, excluding non-operating items. The bottom line beat the Zacks Consensus Estimate of earnings of $1.41 per share. The strong quarterly earnings were driven by higher realizations of commodity prices.

BP's net debt, including leases, was $36,129 million at the end of the first quarter versus $42,380 million in the prior-year quarter. BP announced plans to execute a $2.5-billion share buyback, which is expected to complete before reporting the second-quarter results.

Chevron Corporation CVX reported first-quarter adjusted earnings per share of $3.36, missing the Zacks Consensus Estimate of $3.44 on weaker-than-expected performance from the downstream segment.

As of Mar 31, Chevron had $11.7 billion in cash and cash equivalents, and total debt of $29.3 billion, with a debt-to-total capitalization of 16.7%. Chevron paid out $2.7 billion in dividends and bought back $1.3 billion worth of its shares.

Oceaneering International OII reported a first-quarter 2022 adjusted loss of 6 cents per share, narrower than the Zacks Consensus Estimate of a loss of 10 cents. The outperformance was largely due to strong results in certain segments.

The capital expenditure in the first quarter, including acquisitions, summed at $19.3 million. As of Mar 31, 2022, Oceaneering had cash and cash equivalents worth $438 million and long-term debt of $701.8 million. The total debt-to-total capital was 58.3%. OII anticipates results to improve in the second quarter on a consolidated basis, with quarterly EBITDA forecast between $50 and $70 million on higher revenues.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BP p.l.c. (BP) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

DrilQuip, Inc. (DRQ) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance