Dow Reaches Its Highest Level Since February: 4 Top Picks

On Aug 17, one of the equity markets’ most closely watched indexes, the Dow, closed at its highest level in nearly six months. Wall Street’s bullish wave, which commenced in July, continues in August as the blue-chip index registered a gain in six of the trailing seven weeks.

Recent optimism related to global trade war concerns, a robust U.S. economy and strong earnings results are likely to pave the way for further upside. At this stage, investment in some of these stocks with favorable Zacks Rank will bode well.

The Dow Closes at Its Highest Since February

On Aug 17, the Dow Jones Industrial Average (DJI) closed at 25,669.32, gaining 0.4% or 110.6 points, marking its highest close since Feb 26. Just a day before, the blue-chip index rallied 1.6% or 396.32 points, registering its biggest single day gain since Apr 10, when it jumped 429 points.

Despite severe stock market volatility, the index is up 3.8% year to date. Moreover, a strong bunch of 17 stocks in the total portfolio of 30 in the Dow have provided positive returns so far this year. Nine stocks have provided positive double-digit returns.

Trade-Related Concerns Eased

High-level delegations of the United States and China will sit for another round of negotiations next week to reach some kind of an agreement related to tariff-related issues. Notably, both the countries have imposed $50 billion of tariffs on each other escalating fears of a global trade war.

On Aug 17, The Wall Street Journal reported that both the United States and Chinese negotiators will try their best to reach to a middle path which will eventually pave the way for a summit between President Donald Trump and Chinese leader Xi Jinping in November.

Meanwhile, Mexico’s economy minister, Ildefonso Guajardo stated that he is hopeful about resolving all outstanding bilateral issues in the North American Free Trade Agreement (NAFTA) by the middle of next week. Notably, NAFTA has been vulnerable since June when the Trump administration imposed tariffs on metals imported from both Mexico and Canada.

Robust Earnings Momentum

U.S. corporates have reported robust earnings results for the second quarter of 2018. So far, 467 S&P 500 members have reported their quarterly results. Total earnings of these companies are up 25.5% on 9.9% higher revenues. For the S&P 500 index as a whole, total second-quarter earnings are expected to be up 24.9% from the same period last year on 9.7% higher revenues.

If the current earnings expectation of second-quarter for the S&P 500 index as a whole materializes, it will be the highest quarterly growth pace in almost eight years. In fact, it will exceed the first-quarter 2018’s earnings growth rate of 24.6%. (Read More: Strong Retail Sector Earnings Performance)

Our Picks

Stock markets momentum remained largely unhindered despite volatility. Massive tax cut, business-friendly policies and steady economic activities resulted in robust earnings results. U.S. markets are well positioned to attract investors’ attention by offering high yields.

At this stage, we narrowed down our search to four stocks within the Dow 30, each having either a Zacks Rank #1 (Strong Buy) or 2 (Buy) and strong growth potential.

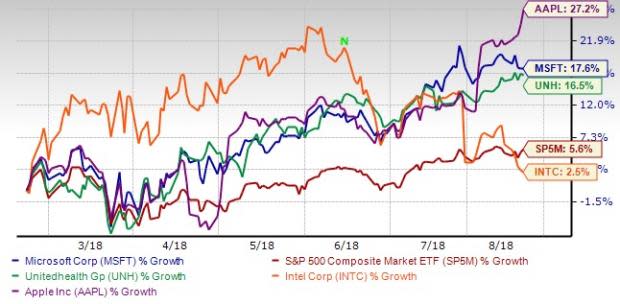

The chart below shows price performance of our four picks in the last six months.

Microsoft Corp. MSFT: The stock provided 11.4% positive earnings surprise in the last four quarters. Microsoft has expected earnings growth of 9.5% for current year. The Zacks Consensus Estimate for the current year has improved by 7.3% over the last 30 days. The stock flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Apple Inc. AAPL: The stock provided 5.5% positive earnings surprise in the trailing four quarters. Apple has expected earnings growth of 26.8% for current year. The Zacks Consensus Estimate for the current year has improved by 2.5% over the last 30 days. The stock carries a Zacks Rank #2.

Intel Corp. INTC: The stock provided 19.9% positive earnings surprise in the preceding four quarters. Intel has expected earnings growth of 19.9% for current year. The Zacks Consensus Estimate for the current year has improved by 3.5% over the last 30 days. The stock has a Zacks Rank #2.

UnitedHealth Group Inc. UNH: The stock provided 3.7% positive earnings surprise in the last four quarters. UnitedHealth has expected earnings growth of 26.3% for current year. The Zacks Consensus Estimate for the current year has improved by 0.8% over the last 30 days. The stock carries a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance