Dover (DOV) Earnings Beat Estimates in Q2, Sales Up Y/Y

Dover Corporation DOV reported second-quarter 2022 adjusted earnings per share (EPS) from continuing operations of $2.14, beating the Zacks Consensus Estimate of $2.08. The bottom line increased 4% year over year.

On a reported basis, Dover delivered EPS of $2 in the quarter, up 10% year over year.

Total revenues in the second quarter increased 6% year over year to a record $2,159 million. The top line missed the Zacks Consensus Estimate of $2,174 million. Strong demand and robust backlog rates coupled with new order bookings drove the top-line growth across most of the company’s businesses during the quarter.

Costs and Margins

Cost of sales rose 9% year over year to $1,377 million in the reported quarter. Gross profit was up 1.2% year over year to $781 million. The gross margin was 36.1% compared with the year-ago quarter’s 38%.

Selling, general and administrative expenses were down 0.8% to $424 million from the prior-year quarter’s tally. Adjusted EBITDA increased 2.2% year over year to $477 million. Adjusted EBITDA margin was 22.1% in the quarter compared with the prior-year quarter’s 23%.

Dover Corporation Price, Consensus and EPS Surprise

Dover Corporation price-consensus-eps-surprise-chart | Dover Corporation Quote

Segmental Performance

The Engineered Products segment’s revenues were up 16% year over year to $514 million in the quarter. The segment’s adjusted EBITDA grew 15% year over year to $88 million.

The Clean Energy & Fueling segment’s revenues came in at $494 million compared with the prior-year quarter’s $437 million. The segment’s adjusted EBITDA was $106 million, up from the prior-year quarter’s $100 million.

The Imaging & Identification segment’s revenues moved down 6% year over year to $276 million. The segment’s adjusted EBITDA declined 7.6% year over year to $65 million.

The Pumps & Process Solutions segment’s revenues increased 2.9% year over year to $441 million in the second quarter. The adjusted EBITDA of the segment totaled $148 million compared with the year-ago quarter’s $156 million.

The Climate & Sustainability Technologies segment’s revenues increased to $434 million from $431 million reported in the year-earlier quarter. The segment’s adjusted EBITDA totaled $71 million compared with $64 million in second-quarter 2021.

Bookings and Backlog

Dover’s bookings at the end of the second quarter were worth $2.10 billion compared with the prior-year quarter’s $2.38 billion. Backlog increased 30% year over year to $3.33 billion at the end of the reported quarter.

Financial Position

The company had a free cash inflow of $129 million in the second quarter compared with the year-ago quarter’s $218 million. Cash flow from operations amounted to $179 million in the quarter under review compared with the prior-year quarter’s $260 million.

Dover recently completed the Malema buyout, which has now become part of the PSG business unit within Dover's Pumps & Process Solutions segment. The acquisition will expand the company’s biopharma single-use production offering.

Outlook

Dover reaffirms adjusted EPS guidance between $8.45 and $8.65 for 2022. It expects organic revenue growth of 8-10% for the year. Robust demand and strong backlog levels will continue to drive revenues and earnings in the current year. The company’s cost control actions, strong volume and improved price and cost will drive profitability in the remaining period of the year.

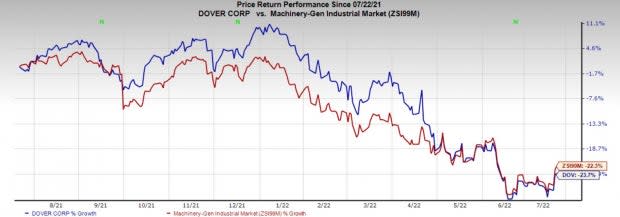

Price Performance

Dover’s shares have declined 23.7% in the past year compared with the industry’s fall of 22.3%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Dover currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Greif Inc. GEF, Titan International TWI and RBC Bearings ROLL. While GEF and TWI each flaunt a Zacks Rank #1 (Strong Buy), ROLL carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Greif has an estimated earnings growth rate of 37% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 17%.

Greif pulled off a trailing four-quarter earnings surprise of 22.9%, on average. The company’s shares have gained 14.7% in the past year.

Titan International has an estimated earnings growth rate of 165% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 43%.

Titan International pulled off a trailing four-quarter earnings surprise of 56.4%, on average. The company’s shares have appreciated 114.7% in a year’s time.

RBC Bearings has an expected earnings growth rate of 48% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 6% in the past 60 days.

RBC Bearings has a trailing four-quarter earnings surprise of 3.4%, on average. ROLL’s shares have moved up 7.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dover Corporation (DOV) : Free Stock Analysis Report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

RBC Bearings Incorporated (ROLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance