Doors Open for 75 Bps Rate Hike on 8.6% Inflation: 3 Bank Picks

The U.S. economy continues to grapple with raging inflation levels. The latest Labor Department report shows that the Consumer Price Index jumped 8.6% year over year last month (the highest level since December 1981), surpassing the market expectations and April’s number of 8.3%.

This bigger-than-expected jump in prices in May has opened the doors for a larger interest rate hike by the Federal Reserve at the end of the two-day policy meeting on Jun 15. Many market participants are contemplating that the central bank, which had earlier shown the intent to continue raising interest rates until inflation is tackled, in a surprise move, might hike the rates by 75 basis points (bps).

Per the CME FedWatch Tool data, there is a 96.3% chance that the Fed will raise the interest rates by 75 bps tomorrow, up from just 23.2% probability on Friday, when the new inflation numbers were out. Against this backdrop, it is advisable to invest in banks as they thrive in a higher interest rate environment. Hence, we have selected — M&T Bank Corporation MTB, First Republic Bank FRC and SVB Financial Group SIVB — as these will benefit from higher interest rates.

Steps Taken So Far Not Enough

The efforts taken so far by the central bank haven’t been enough to curtail inflation. The Fed was already behind the curve when it raised the interest rates for the first time since 2018 this March. Since then, it has been trying to catch up.

The Fed raised interest rates by 25 bps in March, followed by a 50 bps increase in May. At present, the short-term interest rates stand at 0.75-1.00%.

At the end of the May FOMC meeting, the Fed chairman Powell had stated that a 75-bps hike is “not something that the committee is actively considering” and hinted at the possibility of further hikes of 50 bps each in the next two meetings in June and July.

Powell and other officials now seem ready to take drastic steps to tackle red-hot inflation. At a Wall Street Journal event last month, Powell had said, “What we need to see is inflation coming down in a clear and convincing way and we're going to keep pushing until we see that. If we don't see that, we will have to consider moving more aggressively.”

As the economic data point toward a grim picture, the Fed might move more aggressively to handle the out-of-control situation. The officials have stated that they would be guided by the evolving macroeconomic developments. They also are taking note of the growing supply-chain disturbances from the ongoing Russia-Ukraine war crisis and the resurging COVID-19 cases in China.

Bank Stocks to Bet on

The three shortlisted banks are not only expected to benefit from higher rates but also have robust fundamentals. Along with the rate hike expectations, a continued rise in the demand for loans, decent economic growth and business-diversification efforts will likely aid banks’ top-line growth.

Banks, which have seen their margins shrinking since the start of the pandemic in mid-March 2020 due to the near-zero interest rates, are expected to witness improvement in net interest margins (NIM) and net interest income (NII) in the quarters ahead.

The shortlisted banks have a market capitalization of more than $25 billion and currently carry a Zacks Rank #2 (Buy) or better. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

These banks are part of the S&P 500 Index, which entered the bear market yesterday on recessionary fears. Also, all three banks are expected to witness earnings growth for 2022 and 2023.

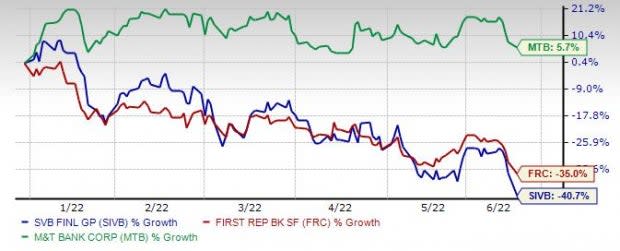

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Supported by a solid balance sheet and liquidity position, M&T Bank is expected to keep expanding through strategic acquisitions. The company has accomplished several major acquisitions in the last several years. In April 2022, MTB completed the acquisition of People's United for $8.3 billion and expects to realize cost savings of $330 million by early 2023, with the deal to be accretive to earnings.

The bank, which has a market cap of $29.8 billion, operates as a solid and sustainable regional bank franchise with a footprint that spans six Mid-Atlantic States and DC. This will likely allow M&T Bank to continue generating a decent level of NII in the upcoming quarters with a gradual improvement in the lending scenario. Also, the company has been undertaking efforts to improve non-interest income.

Management expects NII on a fully tax-equivalent basis to jump 48-52%, depending on the speed of interest rate hikes by the Fed, the pace of deployment of excess liquidity and loan growth. Non-interest income is anticipated to increase in the 11-13% range for 2022.

M&T Bank’s capital deployment activities remain impressive. The company has come a long way in displaying its capital strength and hiked its quarterly dividend by 9.1% in November 2021. In February 2022, the board of directors re-authorized the repurchase of $800 million worth of shares. The buyback program, originally announced in January 2021, was subsequently suspended for the People's United acquisition.

The stock, which currently sports a Zacks Rank of 1, has rallied 5.7% so far this year. For 2022, the company’s earnings are projected to witness year-over-year growth of almost 1%. For 2023, earnings are expected to rise 26.9%.

First Republic Bank has demonstrated considerable top-line strength. The bank’s NII, which is also its primary source of income from operations, witnessed a four-year CAGR of 18% (ended 2021), mainly driven by growth in average interest-earning assets.

In the same time frame, non-interest income grew 19.2%, supported by a steady rise in investment management fees (accounting for almost 66% of fee income as of Mar 31, 2022). Such consistent growth in both NII and fee income suggests optimism about First Republic Bank’s top-line strength.

First Republic Bank’s balance-sheet growth story remains impressive. The company recorded notable growth in loan balances, driven by increased loan origination volumes with a three-year (2019-2021) CAGR of 22%. Also, its total deposits witnessed a CAGR of 31.7% in the same time frame.

For 2022, management expects loans to grow in the mid-teens on the back of solid momentum in household debt refinance products and professional lines of credit. FRC is also optimistic about its ability to continue generating deposits and onboard new clients, which are expected to support loan growth in the upcoming quarters.

In the year-to-date period, FRC has lost 35%. For 2022 and 2023, the company’s earnings are projected to grow 10% and 10%, respectively, on a year-over-year basis. The company, which has a market cap of $25.4 billion, has a Zacks Rank #2 at present.

SVB Financial has a market cap of $26.1 billion. It remains focused on its organic growth strategy, as evident from a consistent rise in loans, deposits and NII over the past several years. The company’s net loans saw a CAGR of 41.6% over the last three years (2019-2021). NII and deposits witnessed a CAGR of 23.1% and 28.5%, respectively, over the same time frame. Further, improving non-interest income will likely keep aiding top-line growth.

For 2022, management projects average loans to grow in the mid-30s and average deposit balances to rise in the low-40s. NII is anticipated to grow in the low-50s, while NIM is projected to be 2.10-2.22%.

SVB Financial is expanding through strategic buyouts, which will continue supporting its position as one of the foremost providers of financing solutions to innovative companies. In its efforts to expand into technology investment banking, it acquired the technology equity research firm, MoffettNathanson, in December 2021. In July, it acquired Boston Private, which is expected to further strengthen its private bank and wealth management offerings.

SIVB has also been undertaking efforts to expand globally. While its U.K. and Asia operations seem to be growing, the businesses in Canada and Germany are expected to further boost revenues. Its international (reflects operations in the U.K., Europe, Israel, Asia and Canada) core fee income witnessed a five-year (ended 2021) CAGR of 34%.

SIVB sports a Zacks Rank #1. For 2022, the company’s earnings are projected to witness year-over-year growth of 6.4%. For 2023, earnings are expected to rise 32%. The company’s shares have plunged 40.7% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance