Doom and gloom talk dominates strong data trends

No amount of strong economic data has been able to silence the economy’s naysayers.

“Whenever the party out of power is characterizing the economy, it’s going to be doom and gloom,” Neil Dutta said, referring to the negative undertones of Donald Trump. “Doom and gloom sells in politics. It sells on Wall Street. How many people do you know that have made a living for themselves just being bearish on the economy all the time?”

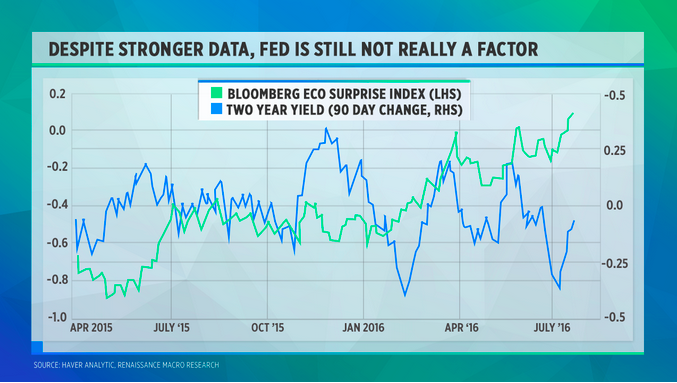

This unfavorable rhetoric unfortunately has the power to affect behavior. Dutta, head of economics for Renaissance Macro, told Yahoo Finance that it limits the likelihood of any near-term Fed action.

Fortunately, the US economy has held up as reflected by the strong data. New home sales are up, consumer confidence is healthy, and jobs growth is robust.

“There’s no question that relative to the rest of the world, the US is doing quite well,” Dutta said.

He added, though, that it will be key to see sustainable strong trends.

“We do have to take some of this with a grain of salt, because we did have a very weak first quarter and so we’re getting a rebound from that,” he said. “To the extent that we see some of this improvement into the third quarter, it becomes more compelling for forecasters and the Fed.”

Meanwhile, Dutta added, the global uncertainty—from Brexit to terrorism and global weakness—may outweigh any US momentum.

“I think what the Fed is basically doing is kind of gravitating toward this role of being a backstop for the global economy,” he said. “What you’re going to see in that environment is inflation in the US run a lot firmer for a lot longer to offset the disinflation everywhere else.”

Meanwhile, low rates have continued to fuel the rally, according to Dutta, something that he predicts will shift as corporate profits improve.

The inflation question

Meanwhile, Dutta said that inflation is picking up.

“We’re seeing it in wages, we’re seeing it in rental prices,” he said. “If inflation continues at the rate it’s been going, we’re going to be at core inflation of 2% by the end of the year.”

What will be interesting to markets going forward? What happens once the Fed does start raising rates, especially if inflation remains sticky, Dutta said.

The bottom line: While expectations remain low for any action during this week’s Federal Reserve meeting, the statement published at 2pm on Wednesday will be scrutinized for acknowledgement of improving US data and changes in outlook for policy change going forward.

Yahoo Finance

Yahoo Finance