'We don't see these food security challenges abating:' Nutrien profit soars to record $3.6 billion

Nutrien Ltd. continued to reel in record profits in the second quarter, but soaring energy prices forced the Saskatoon-based fertilizer producer to scale back its guidance for the rest of the year.

The company on Thursday announced US$3.6 billion in net earnings for the quarter and said its operations generated $2.5 billion in cash through the first half of the year, amid higher commodity prices and strong performance by its retail operations.

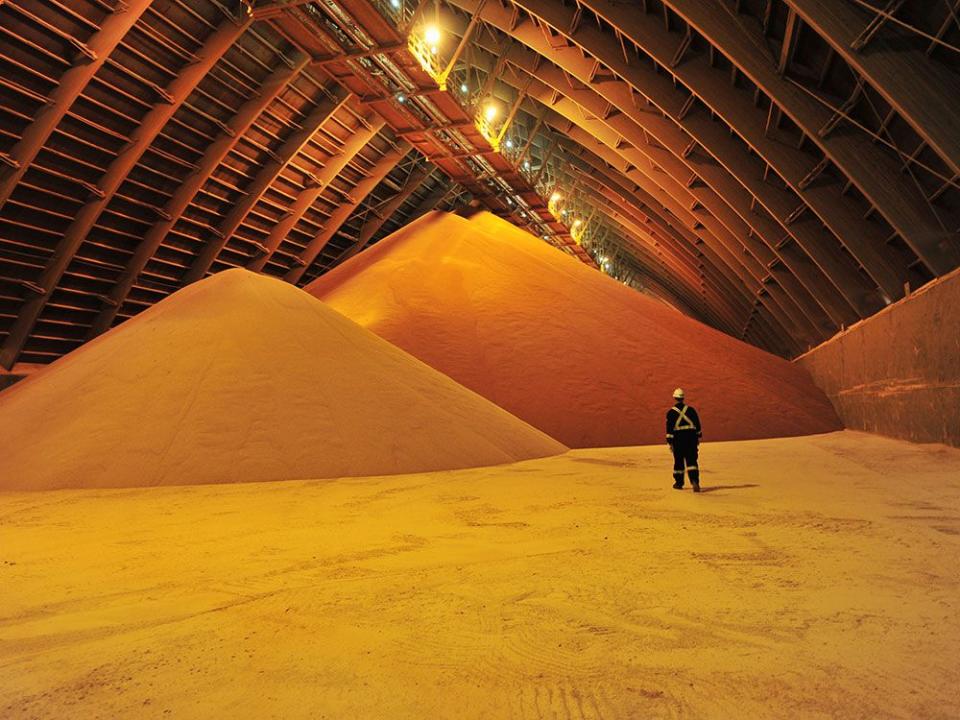

Nutrien, which produces potash, nitrogen and phosphates, and operates an international network of agricultural retail outlets, has been a beneficiary of the havoc wreaked on the global food system by Russia’s invasion of Ukraine, which reduced global grain and fertilizer exports out of the region.

Chief executive Ken Seitz has called the situation a terrible tragedy, saying it will likely increase global hunger, and said Nutrien would increase its annual potash production from six mines in Saskatechewan to 18 million tonnes over the next few years to compensate for missing supply in global markets.

“Obviously this terrible conflict in Ukraine, which we all want to see come to an end as quickly as possible, is having these ripple effects beyond the region,” Seitz said, “It reaches into the energy complex but also into the food system and as a result we’re seeing a strong backdrop in ag fundamentals.”

The company’s share price rose 0.41 per cent on Thursday to $105.73. It is up 15.8 per cent since the beginning of the year.

Higher agricultural commodity prices provided tailwinds for the company’s retail operations, which reported record adjusted EBITDA in the second quarter of US$1.42 billion — compared to US$1.08 billion in 2021.

Meanwhile, the company posted US$2 billion in EBITDA for the quarter from its potash operations, up approximately 311 per cent from US$427 million in the second quarter in 2021.

Its nitrogen business posted EBITDA of US$1.2 billion in the quarter compared to US$554 million last year — a 123 per cent increase.

Amid the record profits the company says it plans to return approximately US$6 billion to shareholders during the year by purchasing 10 per cent of its shares off the open market and through dividends.

BHP accelerates work on its Saskatchewan potash mine as prices soar

Ottawa to give mining giant BHP up to $100 million to cut emissions at Jansen potash project

Mosaic, CF Industries expect global fertilizer supply to remain tight

Historically, Nutrien has posted strong second quarters, when farmers throughout the northern hemisphere replant their crops, purchase fertilizer and spend at Nutrien’s retail outlets.

Still, the company did lower its full-year 2022 guidance for adjusted net earnings per share to US$15.80 from US$17.80 per share. It had previously set expectations at US$16.20 to US$18.70 per share.

The downgraded outlook stems from higher natural gas prices, a key feedstock for nitrogen fertilizer, the company said. Still, the higher costs and lower sales volumes were offset by higher realized prices, it said.

Seitz said it’s another way that the Ukraine conflict could accrue to his company’s benefit down the line if Russia withholds natural gas and makes European nitrogen fertilizer plants less competitive than Nutrien’s operations in North America and Trinidad.

During a call with analysts announcing the results, Seitz also faced a question about whether he expects potash prices to decline in the third quarter.

“We have seen some slight softening,” he said, noting there was a late-start to the spring planting season in North America.

But he added that even if growers were waiting to apply fertilizer until the last minute because of the high prices, he expects pricing for potash to remain stable for the rest of the year.

“We have become sort of more confident in our outlook through 2022 and now 2023,” Seitz said. “It’s just because we don’t see the conflict in Ukraine ending anytime soon … and therefore, we don’t see these food security challenges abating and, you know, therefore, we’ve seen commodity prices remaining at these sort of historically elevated levels.”

• Email: gfriedman@postmedia.com | Twitter: GabeFriedz

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Yahoo Finance

Yahoo Finance