Don’t overthink that weird thing going on with Time Warner’s share price

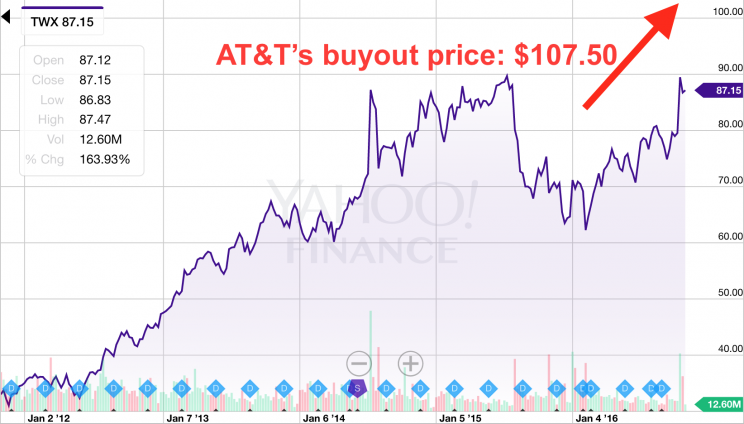

AT&T (T) is buying Time Warner (TWX) for $85 billion, or about $107.50 per share.

Following this announcement, however, Time Warner shares have traded considerably below the deal price, sitting near $87.15 per share on Tuesday afternoon.

So what explains this ~$20 per share spread between the prevailing market price and the implied buyout offer?

Is there something else going on that traders know about? Are there some investors holding out? Is there something about the deal structure that would make TWX shares worth less than the bid?

We hate to disappoint the conspiracy theorists. But there appears to be a much simpler explanation: the market is worried the deal won’t go through.

As we wrote on Monday, the antitrust concerns embedded in the market’s pricing appear not quite as large as Time Warner shares might imply. Big deals, however, garner big scrutiny.

Even still, a $20 a share spread seems large for a deal that, as we wrote on Monday, doesn’t appear to bring with it obviously overwhelming antitrust concerns.

But one trader Yahoo Finance talked to on Tuesday said there was nothing beyond these worries embedded in this big market-to-deal price gap. Analyst commentary following this announcement has also coalesced around this idea.

Andy Hargreaves, an analyst at Pacific Crest, wrote that the “arb spread” — or the gap between Time Warner’s current market price and the deal price — “appears high given our views on regulatory risks.”

In other words, Hargreaves is confident a deal will go through, there not warranting such a large gap between the current and expected closing price for the deal.

Others, however, are less confident in the cleanliness of an expected regulatory process. “Regulatory approval is unlikely to be a slam dunk,” Eric Handler, an analyst at MKM Partners, wrote in a recent note that. “In our view, regulatory review of this acquisition will face intense scrutiny, likely even more so than Comcast’s acquisition of NBC Universal.” Comcast’s NBC Universal acquisition was approved in January 2011 after a December 2009 announcement.

AT&T’s proposal also presents three additional challenges for investors — the presidential election, an expected closing date at the end of 2017, and a payout that is a mix of cash and stock.

The presidential election is leaving markets everywhere in flux, and a new administration could use blocking the AT&T-Time Warner deal, or demanding major concessions from either side, as a way to win early political points.

Additionally, this considerable amount of time passing between a proposed and approved deal presents challenges as it requires any investor acquiring a fresh stake in Time Warner following the news to wait out a long, uncertain period of time to get paid. A lot can change while your money is tied up 15 months or more.

And finally, the mix of cash and stock leaves yet another layer of uncertainty standing between investors and eventual payouts, even with the deal’s built-in protections.

As Jeff Bezos said last week, “Conventional wisdom is usually right.”

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here:

In 1988, Warren Buffett gave the blueprint for trading a weird thing happening right now

Yahoo Finance

Yahoo Finance