Don't Ignore the Strength of These 3 Small-Caps

There are various approaches to investing. Investors can choose from many different styles, including prioritizing generating income, targeting value stocks, or investing in particular industries.

And some investors may prefer a more aggressive approach, such as investing in small-cap stocks that boast significant growth potential due to them being in their early stages.

After all, don’t we all dream of getting in early on the next big thing?

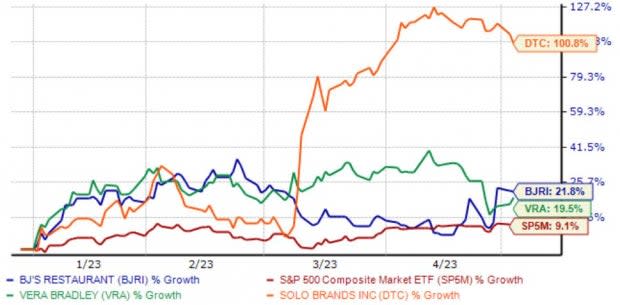

Three stocks – Vera Bradley VRA, Solo Brands DTC, and BJ’s Restaurants BJRI – could all be considerations for those with an appetite for small caps. Below is a chart illustrating the year-to-date performance of all three, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three have witnessed considerable momentum year-to-date, outperforming the general market handily.

In addition, all three sport improved earnings outlooks, indicating near-term optimism from analysts. Let’s take a closer look at each.

Vera Bradley

Vera Bradley Designs is a designer, producer, marketer, and retailer of accessories for women. Its products include handbags, accessories, and travel and leisure items. The company currently sports a favorable Zacks Rank #2 (Buy), with analysts raising their outlook across nearly all timeframes.

Vera Bradley posted results that had the market impressed in its latest release, exceeding earnings expectations by more than 6% and delivering a 7.3% positive revenue surprise. As we can see in the chart below, the results pushed VRA shares into a solid uptrend.

Image Source: Zacks Investment Research

And despite strong price action in 2023, VRA shares aren’t expensive on a relative basis, with the current 12.6X forward earnings multiple nearly in line with the five-year median.

The company sports a Style Score of “A” for Value.

Image Source: Zacks Investment Research

Further, Vera Bradley’s growth trajectory remains bright, with the Zacks Consensus EPS Estimate of $0.42 for its current fiscal year (FY24) indicating an improvement of 75% year-over-year. And in FY25, earnings are forecasted to climb a further 35%.

Solo Brands

Solo Brands is a direct-to-consumer (DTC) platform that offers products primarily online through its lifestyle brands. The company currently sports the highly-coveted Zacks Rank #1 (Strong buy).

Like VRA, Solo Brands has been a strong earnings performer as of late, exceeding the Zacks Consensus EPS estimate by at least double-digit percentages in each of its five prints. Just in its latest quarter, DTC posted a 43% EPS beat paired with a nearly 30% revenue beat.

Needless to say, investors took the better-than-expected results in stride, sending shares soaring post-earnings.

Image Source: Zacks Investment Research

BJ’s Restaurants

BJ's Restaurants owns and operates a chain of high-end casual dining restaurants in the U.S. Presently, BJRI is a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Keep an eye out for BJRI’s upcoming release in mid-July, as the Zacks Consensus EPS estimate of $0.32 indicates a 220% year-over-year climb within earnings. Our consensus revenue estimate currently sits at $350 million, implying an improvement of roughly 6% from the year-ago quarter.

Image Source: Zacks Investment Research

In addition, BJRI’s shares could entice value-focused investors, as the company’s current 0.6X forward price-to-sales ratio resides below the five-year median and the Zacks Retail and Wholesale sector average by fair margins.

The company currently carries a Style Score of “B” for Value.

Image Source: Zacks Investment Research

Bottom Line

For those who can handle a higher level of volatility and have a less conservative approach, small-cap stocks could be solid considerations.

While their price swings can undoubtedly become spooky, their growth potential is impressive.

And all three above – Vera Bradley VRA, Solo Brands DTC, and BJ’s Restaurants BJRI – boast strong growth trajectories with improved earnings outlooks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Vera Bradley, Inc. (VRA) : Free Stock Analysis Report

Solo Brands, Inc. (DTC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance