Donaldson (DCI) Hikes Dividend, to Repurchase 13M Shares

Donaldson Company, Inc. DCI has announced that it is giving twin rewards in forms of share buyback authorization and hike in the quarterly dividend to its shareholders. These rewards were approved by its board of directors.

We believe that such disbursements reflect Donaldson’s shareholder-friendly policies and strong cash position.

Details of Share Buyback & Quarterly Dividend

Under the new buyback program, Donaldson has been allowed to repurchase up to 13 million shares (i.e. equivalent to 10% of its shares outstanding). It is worth mentioning here that the new buyback program replaces the repurchase program of 14 million shares approved in May 2015 (of which 11.6 million shares were bought back to date).

Additionally, the company announced 10.5% or 2 cents per share hike in the quarterly dividend rate, which now increased from 19 cents to 21 cents. On an annualized basis, the dividend increased to 84 cents per share from 76 cents.

Donaldson will pay the revised dividend on Jun 28, 2019, to shareholders of record as of Jun 13.

Sound Capital-Allocation Strategies

Donaldson uses free resources for strengthening its growth prospects and rewarding shareholders through share buybacks, and dividend payments.

Over the last five fiscal years (2014-2018), the company’s annual dividend payments increased from 57.5 cents per share in 2014 to 73 cents in 2018. Also, it bought back shares worth $882.4 million during the same time frame.

In the first half of fiscal 2019 (ended Jan 31, 2019), the company distributed a dividend of 38 cents per share and bought back shares worth $102 million.

Zacks Rank & Stocks to Consider

With a market capitalization of $6.1 billion, Donaldson currently carries a Zacks Rank #4 (Sell). The company is suffering from adverse impacts of high raw material costs and weak Gas Turbine Systems business. However, segmental growth opportunities, capital investments and innovation programs might bring in some relief.

In the past three months, the company’s shares have declined 7.8% against the industry’s growth of 1%.

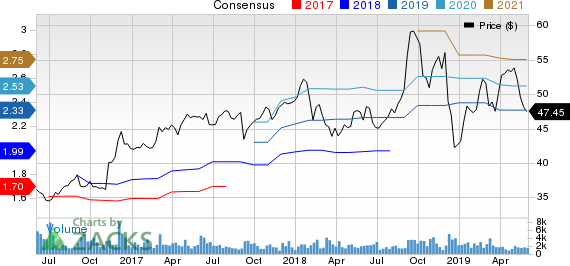

In the past 60 days, the Zacks Consensus Estimate for Donaldson’s earnings remained unchanged at $2.33 for fiscal 2019 (ending July 2019) and decreased 0.4% to $2.53 for fiscal 2020 (ending July 2020).

Donaldson Company, Inc. Price and Consensus

Donaldson Company, Inc. price-consensus-chart | Donaldson Company, Inc. Quote

Some better-ranked stocks in the Zacks Industrial Products sector are CECO Environmental Corp. CECE, Tetra Tech, Inc. TTEK and Roper Technologies, Inc. ROP. All these stocks currently sport a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, earnings estimates for all these three stocks have improved for the current year. Further, average earnings surprise for the last four quarters was positive 25% for CECO Environmental, 8.22% for Tetra Tech and 8.43% for Roper.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

CECO Environmental Corp. (CECE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance