Don't Overlook Ulta Beauty's Sales Productivity

On Ulta Beauty Inc.'s (NASDAQ: ULTA) earnings conference call last week, CFO Scott Settersten mildly chided Wall Street analysts for trying to read too much into the company's promotional strategy, using limited points of data:

We believe that there's probably way too much time and attention being invested in attempting to track the number of promotional offers each quarter and trying to read through that on the impacts of gross profit...we see reports quite often that place a lot of weight on a very limited view into only one element of our overall promotional tool box, and that being primarily the 20%-off postcard. So you guys, nobody's taking into account all the other promotional things that we do that are part and parcel of our everyday business, things around merchandising discounts and offers in our circulars, and of course the loyalty program."

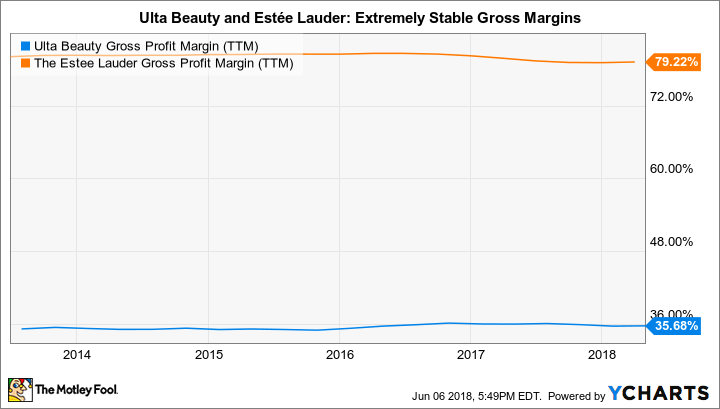

To this reasonable complaint, I'd only add that overthinking how Ulta's gross margin might change each quarter won't yield much fruit for the time invested. As my colleague Vincent Shen and I discussed in a recent podcast devoted to Ulta Beauty and beauty peer Estee Lauder (NYSE: EL), Ulta maintains an extremely stable gross margin, quarter in and quarter out. It shares this trait with Estee Lauder, which sports a higher gross margin due to its relative dearth of brick-and-mortar stores. Take a look at the following chart, encompassing five years:

ULTA gross profit margin (TTM) data by YCharts.

Given the admirably flat trend line above, why do analysts and some retail investors still fret over Ulta's gross margin? First, there's precious little room for error in the space between the company's typical 35% gross margin and the 15% long-term operating margin it hopes to achieve. In its most recent quarter, Ulta booked operating margin of 13.6%. A percentage point or two of slip-up in gross profitability would put the 15% goal further out of reach.

More germane, however, are worries over threats from online commerce and changing consumer purchase habits. Ulta Beauty maintains an extremely capital-intensive business model -- the beauty specialist currently operates more than 1,100 stores.

Thus, a sudden erosion in gross margin, coupled with, say, a declining traffic trend, could serve as an early warning signal that the online commerce disruption that has hit so many other physical retailers has found its way to Ulta's door.

Image source: Getty Images.

Allaying margin and competitive e-commerce fears

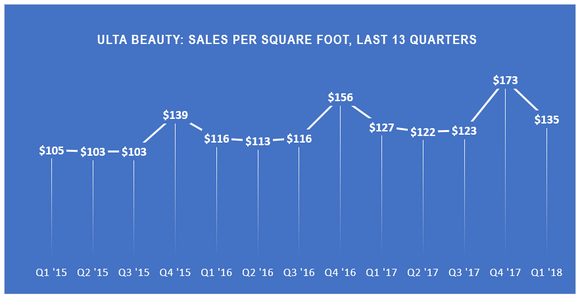

One way to feel more at ease with Ulta's business model is to examine the company's sales productivity. Let's view Ulta's sales per square foot over a period of 13 quarters -- that is, a little more than three years:

Chart by author based on data from Ulta Beauty SEC filings. Data points calculated from an average of quarterly beginning and ending total retail square footage.

There are several points to observe above. First, you'll notice the company enjoys a huge fourth quarter annually during the busy end-of-year holiday season in the U.S. But the chart also evinces a climbing step pattern, as the next three quarters outpace their prior-year counterparts.

In the first quarter of 2015, Ulta's total retail square footage comprised 8.2 million square feet. By the first quarter of 2018, total square footage had ballooned to 11.3 million square feet -- an increase of 42%. Aggressive store expansion has provided the foundation for Ulta's annual double-digit revenue increases, which now almost seem routine.

But simultaneously, the organization has amplified the amount of revenue attached to each square foot of space, arguably a more difficult task. Ulta Beauty is expanding sales per square foot at a compounded annual growth rate, or CAGR, of nearly 9%.

Many factors inform how the company is able to ramp up productivity in its selling areas. Besides its own products, Ulta offers access to literally hundreds of brands, which begin at entry-level labels. Yet stores tend to focus on higher-ticket prestige names, such as Estee Lauder, MAC, and Chanel, for example.

Ulta utilizes customer affinity to its advantage. Management observes that the company's "Ultamate Rewards" loyalty program is a powerful tool in driving higher traffic and incremental purchases, from a base that includes some 28.6 million active users.

Additionally, a portion of e-commerce sales, which comprise about 10% of total company revenue, is tied to in-store visits. Ulta offers a "store-to-door" service, in which patrons shop online in store and receive delivery of products shipped to their homes. The retailer is also introducing a "shop online, pick up in store" option, which will launch later this year.

More recently, Ulta has firmed up partnerships with social brands like PopSugar, Spotify, Pandora, and even the traffic app Waze, thus connecting with a younger demographic to provide longer-term traffic into stores.

In sum, no physical retailer is immune to rapidly evolving consumption habits, which punish complacency and can rapidly shift a corporation's fortunes. But Ulta Beauty perennially derives more, not less, revenue from the square footage of its vast and growing real estate base. As long as sales productivity continues to climb, shareholders have no real reason to second-guess Ulta's business model.

More From The Motley Fool

Asit Sharma has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Pandora Media. The Motley Fool recommends Ulta Beauty. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance