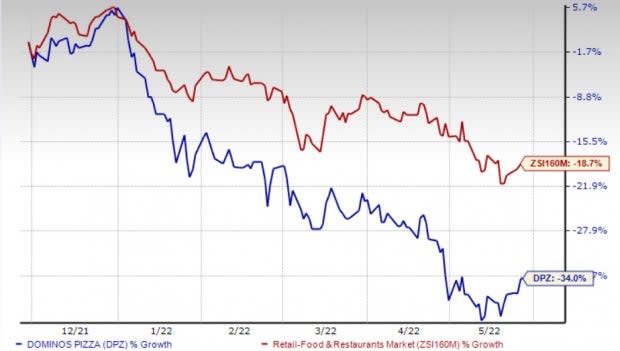

Domino's (DPZ) Falls 34% in 6 Months: What's Hurting It?

Are you still holding shares of Domino's Pizza, Inc. DPZ and waiting for a miracle to take the stock higher in the near term? If yes, then you might lose more money as chances are very slim that the stock, which has lost its value by 34% in the past six months, will take a U-turn in the near term. At the same time, the Zacks Restaurant industry declined 18.7%. Let’s delve deeper and analyze the factors that are hurting this Zacks Rank #5 (Strong Sell) company.

Primary Concerns

The company’s business continues to be impacted by the coronavirus pandemic. During the fiscal first quarter, Domino’s operations were negatively impacted by the Omicron-induced labor shortages and capacity constraints. Lack of order fulfillment, particularly for delivery customers, led to the downside. Although the company undertook certain initiatives to improve staffing levels, complete recovery is likely to take time. Nevertheless, it continues to regularly monitor the pandemic so as to operate and survive amid such trying times.

Dismal comps are hurting the company. During the fiscal first quarter, comps at Domino’s domestic stores (including company-owned and franchise stores) declined 3.6% year over year against year-over-year growth of 13.4% reported in the prior-year quarter. The downside was primarily due to a fall in order counts partially offset by ticket growth. Limited operating hours (due to staffing challenges) and supply chain challenges (on account of labor issues within distribution channels) further added to the downside.

Inflationary pressures in commodity, labor and fuel costs continue to hurt the company. The industry players have been witnessing higher costs for quite some time due to labor and supply chain shortages. Domino’s has been no exception to the trend. The company has been witnessing labor challenges in a handful of markets. During the fiscal first quarter, the company’s total cost of sales amounted to $642.5 million compared with $594.5 million reported in the prior-year quarter. Going forward, the company anticipates fluctuations in commodity prices (including wheat) and fuel costs stemming from geopolitical risks and the impact on the overall macroeconomic environment.

Image Source: Zacks Investment Research

Growth Projections

The company’s earnings in 2022 is likely to witness a decline of 6.3%. In the past 30 days, the Zacks Consensus Estimate for 2022 earnings has witnessed a downward revision of 9.6% to $12.75. However, in 2022, revenues are likely to witness growth of 5.2% year over year.

3 Picks You Can’t Miss Out On

Some better-ranked stocks in the Zacks Retail-Wholesale sector are MarineMax, Inc. HZO, BBQ Holdings, Inc. BBQ and Cracker Barrel Old Country Store CBRL.

MarineMax sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 32.8%, on average. Shares of the company have declined 23.8% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MarineMax’s 2022 sales and earnings per share (EPS) suggests growth of 16% and 21.5%, respectively, from the year-ago period’s levels.

BBQ Holdings carries a Zacks Rank #2 (Buy). BBQ Holdings has a long-term earnings growth of 14%. Shares of the company have decreased 18.3% in the past year.

The Zacks Consensus Estimate for BBQ Holdings’ 2022 sales and EPS suggests growth of 46.1% and 67.6%, respectively, from the year-ago period’s levels.

Cracker Barrel carries a Zacks Rank #2. Cracker Barrel has a long-term earnings growth of 9.4%. Shares of the company have declined 37.8% in the past year.

The Zacks Consensus Estimate for Cracker Barrel’s 2022 sales and EPS suggests growth of 17.3% and 33.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cracker Barrel Old Country Store, Inc. (CBRL) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

BBQ Holdings, Inc. (BBQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance