Dominion Energy (D) Q3 Earnings Beat Estimates, Revenues Lag

Dominion Energy Inc. D reported third-quarter 2021 operating earnings of $1.11 per share, which surpassed the Zacks Consensus Estimate by 4.7%. Quarterly earnings were higher than the guided range of 95 cents to $1.10 per share.

Operating earnings also improved 2.8% year over year.

GAAP earnings were 79 cents per share compared with 41 cents in the year-ago quarter.

Revenues

Dominion Energy’s total revenues came in at $3,176 million, which lagged the Zacks Consensus Estimate of $3,846 million by 17.4% and declined 11.9% from $3,607 million in the year-ago quarter.

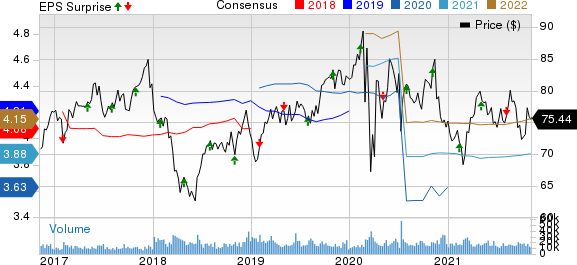

Dominion Energy Inc. Price, Consensus and EPS Surprise

Dominion Energy Inc. price-consensus-eps-surprise-chart | Dominion Energy Inc. Quote

Highlights of the Release

Total operating expenses decreased 34.8% year over year to $2,335 million due to a decline in operating and maintenance costs.

Interest and related charges for the reported quarter were $407 million, up 33% from the year-ago period.

Segment Details

Dominion Energy Virginia: Net income from this segment was $599 million, down 2.3% year over year.

Gas Distribution: Net income from this segment was $69 million, up 7.8% on a year-over-year basis.

Dominion Energy South Carolina: Net income from this segment was $151 million, down 3.8% year over year.

Contracted Assets: Net income from this segment was $119 million, up 6.3% year over year.

Corporate and Other: Net loss was $20 million compared with a loss of $30 million in the year-ago quarter.

Financial Highlights

As of Sep 30, 2021, Dominion Energy had $180 million in cash and cash equivalents compared with $172 million on Dec 31, 2020.

Total long-term debt as of Sep 30, 2021 was $31,641 million, up from $30,915 million on Dec 31, 2020.

For the first nine months of 2021, cash provided from operating activities was $3,535 million, down 26.5% from $4,810 million in the year-ago period.

Guidance

The company initiated its fourth-quarter 2021 operating earnings guidance in the range of 85-95 cents per share. It reported earnings of 81 cents per share in the year-ago period. The midpoint of the above guided range is 90 cents, lower than the current Zacks Consensus Estimate for the period of 96 cents per share.

The company narrowed 2021 earnings per share expectation to the range of $3.80-$3.90 from $3.70-$4.00. The midpoint of the guidance is $3.85 per share, which is lower than the current Zacks Consensus Estimate for the period is $3.89 per share.

Growth capital expenditure for the 2021-2025 period is expected to be $32 billion and nearly 82% of the planned expenditure will be directed for lowering emissions.

Zacks Rank

Currently, Dominion Energy has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Exelon Corporation’s EXC third-quarter 2021 earnings of $1.09 per share missed the Zacks Consensus Estimate by a penny.

FirstEnergy Corporation FE came up with third-quarter 2021 operating earnings of 82 cents per share, surpassing the Zacks Consensus Estimate of 81 cents by 1.2%.

NextEra Energy, Inc. NEE reported third-quarter 2021 adjusted earnings of 75 cents per share, which beat the Zacks Consensus Estimate of 72 cents by 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance