Does Vapotherm (NYSE:VAPO) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Vapotherm, Inc. (NYSE:VAPO) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Vapotherm

What Is Vapotherm's Net Debt?

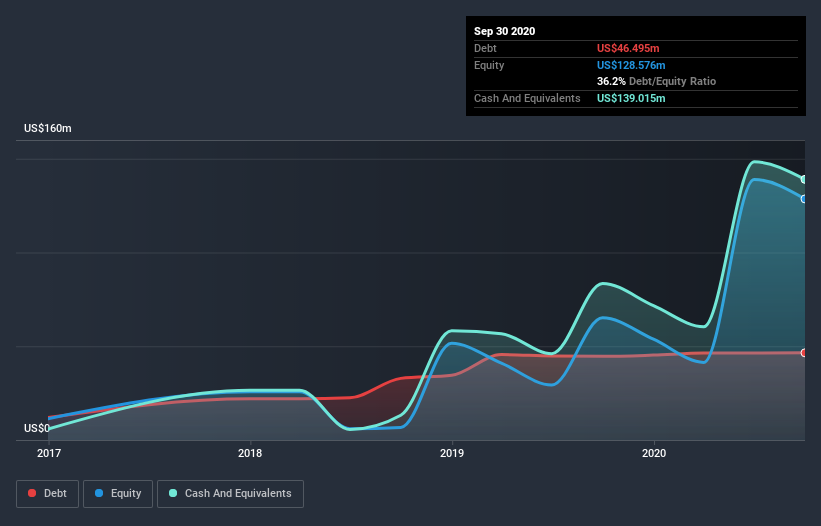

As you can see below, at the end of September 2020, Vapotherm had US$46.5m of debt, up from US$44.6m a year ago. Click the image for more detail. However, it does have US$139.0m in cash offsetting this, leading to net cash of US$92.5m.

How Strong Is Vapotherm's Balance Sheet?

We can see from the most recent balance sheet that Vapotherm had liabilities of US$30.2m falling due within a year, and liabilities of US$42.9m due beyond that. Offsetting these obligations, it had cash of US$139.0m as well as receivables valued at US$10.9m due within 12 months. So it can boast US$76.8m more liquid assets than total liabilities.

This surplus suggests that Vapotherm has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Vapotherm has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Vapotherm's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Vapotherm wasn't profitable at an EBIT level, but managed to grow its revenue by 109%, to US$98m. So its pretty obvious shareholders are hoping for more growth!

So How Risky Is Vapotherm?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Vapotherm had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$51m of cash and made a loss of US$47m. But at least it has US$92.5m on the balance sheet to spend on growth, near-term. The good news for shareholders is that Vapotherm has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Vapotherm , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance