How Does Sprott Inc (TSE:SII) Fare As A Dividend Stock?

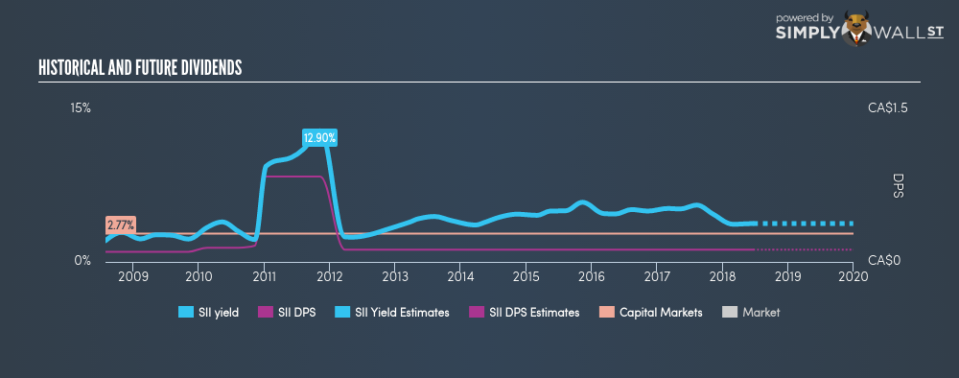

A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. In the past 10 years Sprott Inc (TSE:SII) has returned an average of 5.00% per year to investors in the form of dividend payouts. Should it have a place in your portfolio? Let’s take a look at Sprott in more detail. View out our latest analysis for Sprott

5 checks you should do on a dividend stock

Whenever I am looking at a potential dividend stock investment, I always check these five metrics:

Does it pay an annual yield higher than 75% of dividend payers?

Has its dividend been stable over the past (i.e. no missed payments or significant payout cuts)?

Has dividend per share risen in the past couple of years?

Is is able to pay the current rate of dividends from its earnings?

Will the company be able to keep paying dividend based on the future earnings growth?

Does Sprott pass our checks?

The company currently pays out 67.50% of its earnings as a dividend, according to its trailing twelve-month data, meaning the dividend is sufficiently covered by earnings. Furthermore, analysts have not forecasted a dividends per share for the future, which makes it hard to determine the yield shareholders should expect, and whether the current payout is sustainable, moving forward.

Reliablity is an important factor for dividend stocks, particularly for income investors who want a strong track record of payment and a positive outlook for future payout. Whilst its per-share payments have increased during the past 10 years, there has been some hiccups. Shareholders would have seen a few years of reduced payments in this time.

In terms of its peers, Sprott has a yield of 3.77%, which is high for Capital Markets stocks but still below the market’s top dividend payers.

Next Steps:

Whilst there are few things you may like about Sprott from a dividend stock perspective, the truth is that overall it probably is not the best choice for a dividend investor. But if you are not exclusively a dividend investor, the stock could still be an interesting investment opportunity. Given that this is purely a dividend analysis, I recommend taking sufficient time to understand its core business and determine whether the company and its investment properties suit your overall goals. Below, I’ve compiled three pertinent factors you should further examine:

Future Outlook: What are well-informed industry analysts predicting for SII’s future growth? Take a look at our free research report of analyst consensus for SII’s outlook.

Historical Performance: What has SII’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Dividend Rockstars: Are there better dividend payers with stronger fundamentals out there? Check out our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance