Does Sierra Wireless, Inc. Have More Room to Run?

Sierra Wireless, Inc. (TSX:SW)(NASDAQ:SWIR) is a great play on the Internet of Things (IoT), which is expected to grow by leaps and bounds over the next few years. The stock exposes Canadian investors to the high-flying tech industry without having to play the currency game. Sierra stock recently soared into the atmosphere following a very impressive Q4 2016 earnings report, but is there still room for outperformance? Or is the stock going to flatline for the remainder of the year?

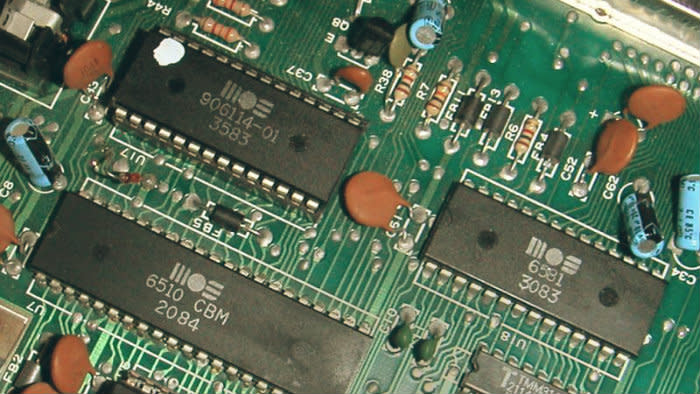

The IoT is one of the fastest-growing industries out there. In a few years, we?ll see everything connected to the internet from your light bulbs to your toasters. That?s a lot of room for growth, and Sierra is at the forefront of the action.

The company has a contract with German auto company Volkswagen Group, which will be a huge driver of growth for the company?s OEM solutions segment. Sierra?s AR series cellular modems are going to provide secure high-speed connectivity to Volkswagen?s new cars to the cloud. Using Sierra?s connectivity solution, the cars will be able to run diagnostics, remote access, and maintenance through various third-party interfaces.

The OEM solutions segment hasn?t been very strong of late, but this could all change once Sierra picks up momentum in this space. It?s likely we could see more contract wins if the Volkswagen partnerships are successful. SNS Telecom Research believes that the connected car services market will grow to approximately $41 billion by 2020, and if Sierra can capture a chunk of that market share, shares will soar.

Going forward, the management team expects Q1 2017 revenue to be between US$152 million and US$161 million with earnings per share in the range of $0.13-0.20. Analysts will definitely be expecting more from the company this year, but there?s reason to believe that the company can still continue to surprise since it?s firing on all cylinders in an incredible market with ample growth opportunities.

The stock currently trades at a 60.82 price-to-earnings, which seems ridiculously expensive, but I think the stock is worth picking up today if your intention is to hold it for the long term. The IoT industry is the place to be if you want a growth, so I think you?ll do well a few years down the road, even if the stock seems expensive now.

In the near term, the stock has had its run, and all the easy profits have been made. I?m not sure where the stock is heading for the remainder of the year, but if you?re going to buy shares today, make sure you own it; don?t trade it. It?s possible that the stock could face volatility this year, so be ready to buy more shares on any signs of weakness.

Stay smart. Stay hungry. Stay Foolish.

Six "pro" strategies for today's highly uncertain market

Motley Fool Canada's $250,000-real-money-portfolio service, Motley Fool Pro, is currently closed to new members. But lead advisor Jim Gillies is doing something special for investors who are worried about the market and where it will head in 2017.

He's revealing the six strategies he uses in Pro to help members guardrail their portfolios and make money in up, down, and sideways markets.

For a limited time you can download this "Pro 2017 Survival Guide" free of charge by simply clicking here.

More reading

Fool contributor Joey Frenette has no position in any stocks mentioned. David Gardner owns shares of Sierra Wireless. The Motley Fool owns shares of Sierra Wireless.

Six "pro" strategies for today's highly uncertain market

Motley Fool Canada's $250,000-real-money-portfolio service, Motley Fool Pro, is currently closed to new members. But lead advisor Jim Gillies is doing something special for investors who are worried about the market and where it will head in 2017.

He's revealing the six strategies he uses in Pro to help members guardrail their portfolios and make money in up, down, and sideways markets.

For a limited time you can download this "Pro 2017 Survival Guide" free of charge by simply clicking here.

Fool contributor Joey Frenette has no position in any stocks mentioned. David Gardner owns shares of Sierra Wireless. The Motley Fool owns shares of Sierra Wireless.

Yahoo Finance

Yahoo Finance