Does DATA Communications Management (TSE:DCM) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like DATA Communications Management (TSE:DCM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide DATA Communications Management with the means to add long-term value to shareholders.

Check out our latest analysis for DATA Communications Management

How Fast Is DATA Communications Management Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that DATA Communications Management's EPS went from CA$0.036 to CA$0.32 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of DATA Communications Management shareholders is that EBIT margins have grown from 5.7% to 9.9% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

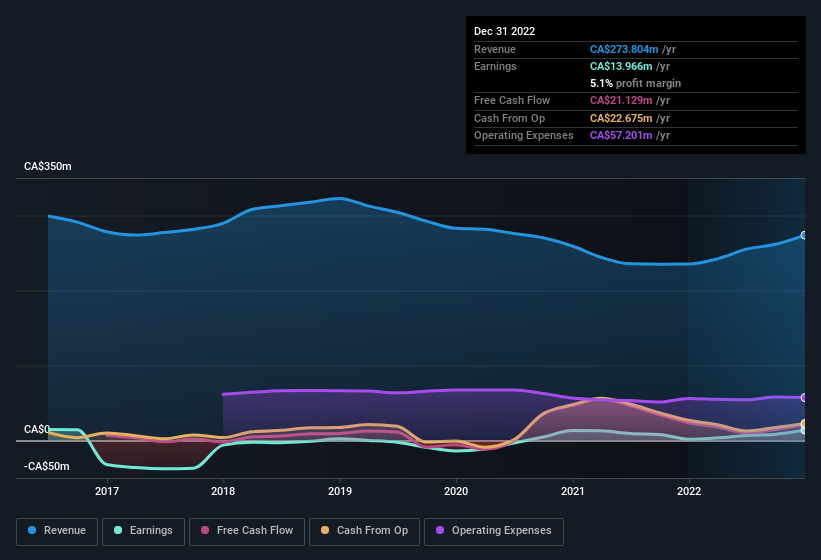

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since DATA Communications Management is no giant, with a market capitalisation of CA$140m, you should definitely check its cash and debt before getting too excited about its prospects.

Are DATA Communications Management Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see DATA Communications Management insiders walking the walk, by spending CA$296k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. We also note that it was the Independent Vice Chairman of the Board, Gregory Cochrane, who made the biggest single acquisition, paying CA$270k for shares at about CA$1.35 each.

Along with the insider buying, another encouraging sign for DATA Communications Management is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at CA$38m. This considerable investment should help drive long-term value in the business. Those holdings account for over 27% of the company; visible skin in the game.

Should You Add DATA Communications Management To Your Watchlist?

DATA Communications Management's earnings have taken off in quite an impressive fashion. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe DATA Communications Management deserves timely attention. We should say that we've discovered 1 warning sign for DATA Communications Management that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, DATA Communications Management isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance