Does CVR Energy (NYSE:CVI) Deserve A Spot On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like CVR Energy (NYSE:CVI). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for CVR Energy

How Fast Is CVR Energy Growing Its Earnings Per Share?

In the last three years CVR Energy's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Over twelve months, CVR Energy increased its EPS from US$3.76 to US$4.06. That's a modest gain of 8.0%.

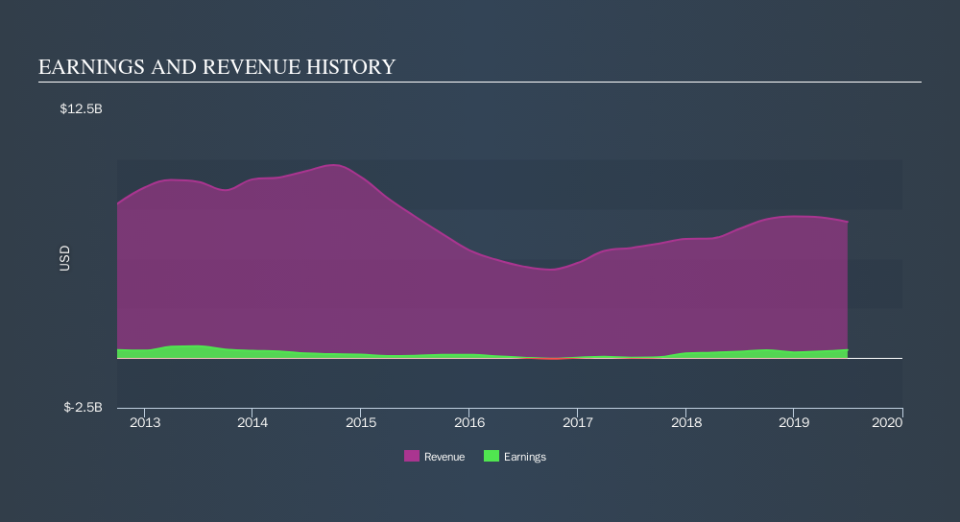

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. CVR Energy shareholders can take confidence from the fact that EBIT margins are up from 4.3% to 10%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future CVR Energy EPS 100% free.

Are CVR Energy Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between US$2.0b and US$6.4b, like CVR Energy, the median CEO pay is around US$5.1m.

CVR Energy offered total compensation worth US$4.4m to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is CVR Energy Worth Keeping An Eye On?

As I already mentioned, CVR Energy is a growing business, which is what I like to see. Not only that, but the CEO is paid quite reasonably, which makes me feel more trusting of the board of directors. So all in all I think it's worth at least considering for your watchlist. Now, you could try to make up your mind on CVR Energy by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although CVR Energy certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance