Dividend Watch: 3 Companies Boosting Payouts

Several companies have been delivering positive news to shareholders lately, such as dividend increases.

When a company opts to raise its dividend, it’s an indication of confidence in its current standing and future prospects. In addition, it reflects the company’s commitment to returning value to shareholders, undoubtedly encouraging.

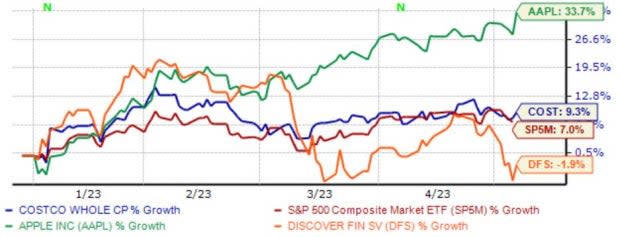

Three companies – Apple AAPL, Discover Financial Services DFS, and Costco Wholesale COST – have all recently declared a dividend hike. Below is a chart illustrating the performance of all three year-to-date, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those with an appetite for income, let’s take a closer look at how each company currently stacks up.

Discover Financial Services

Discover raised its quarterly cash dividend by 17% to $0.70 per share following Q1 results, payable on June 8th, 2023. The company posted somewhat-mixed results, exceeding revenue expectations by 2.6% but falling short of the Zacks Consensus EPS Estimate by a fair margin.

As we can see in the chart below, the company has had little issue increasingly rewarding its shareholders.

Image Source: Zacks Investment Research

DFS shares aren’t valuation stretched, with the current 6.8X forward earnings multiple sitting nicely beneath the 2022 high of 9.6X and the Zacks Finance sector average. The company presently sports a Style Score of “A” for value.

Image Source: Zacks Investment Research

And to top it off, the company’s cash-generating abilities are solid; DFS reported free cash flow of $1.7 billion in its latest release, improving modestly from the year-ago quarter.

Image Source: Zacks Investment Research

Apple

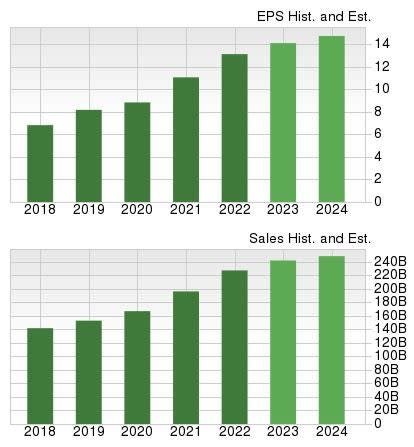

Apple’s quarterly results stole the show after yesterday’s close, with the company delivering a positive 5.6% EPS surprise and reporting revenue nearly 2% above expectations. The company also announced a 4% increase to its quarterly cash dividend, payable on May 18th.

The dividend increases from Apple have added up over the years, and this is on top of the unbelievable price return that shares have provided.

Image Source: Zacks Investment Research

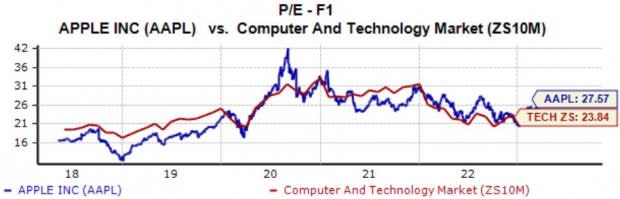

Apple shares are currently a bit expensive, trading at a 27.6X forward earnings multiple, well above the 24.3X five-year median. Still, investors have had little issue forking up the premium for Apple shares, as they’ve quickly become a safe haven in a somewhat-cloudy economic outlook.

Image Source: Zacks Investment Research

Costco Wholesale

On April 19th, Costco revealed that its Board of Directors declared a 13% increase to its quarterly dividend, bringing the quarterly payout to $1.02 per share. Impressively, the company’s payout has increased by more than 11% over the last five years.

The company is forecasted to grow steadily, with earnings forecasted to climb nearly 10% in its current fiscal year (FY23) and a further 8% in FY24. The projected earnings improvement comes on top of forecasted Y/Y revenue growth of 6.5% in FY23 and 5.5% in FY24.

Image Source: Zacks Investment Research

Like DFS, Costco’s cash-generating abilities were displayed in its latest quarterly results; free cash flow totaled $2.3 billion, reflecting a sizable jump from the year-ago period.

Image Source: Zacks Investment Research

Bottom Line

Dividend increases are a positive announcement that shareholders can receive as it reflects the current state of business and future expectations. After all, if a company is struggling, why would it raise its dividend?

And all three companies above – Apple AAPL, Discover Financial Services DFS, and Costco Wholesale COST – have recently declared a dividend hike.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Discover Financial Services (DFS) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance