Dividend Investors: Don't Be Too Quick To Buy C-Com Satellite Systems Inc. (CVE:CMI) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see C-Com Satellite Systems Inc. (CVE:CMI) is about to trade ex-dividend in the next 3 days. This means that investors who purchase shares on or after the 6th of February will not receive the dividend, which will be paid on the 21st of February.

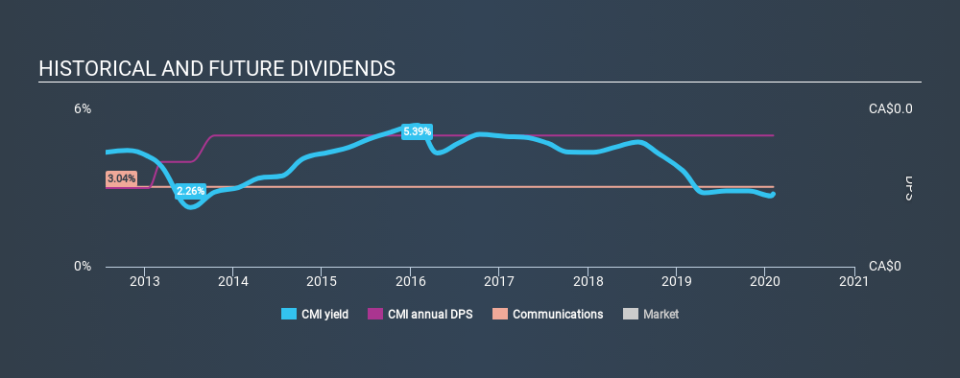

C-Com Satellite Systems's upcoming dividend is CA$0.013 a share, following on from the last 12 months, when the company distributed a total of CA$0.05 per share to shareholders. Based on the last year's worth of payments, C-Com Satellite Systems has a trailing yield of 2.8% on the current stock price of CA$1.8. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether C-Com Satellite Systems can afford its dividend, and if the dividend could grow.

See our latest analysis for C-Com Satellite Systems

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Last year C-Com Satellite Systems paid out 110% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow.

It's good to see that while C-Com Satellite Systems's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see how much of its profit C-Com Satellite Systems paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by C-Com Satellite Systems's 15% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. C-Com Satellite Systems has delivered an average of 6.6% per year annual increase in its dividend, based on the past eight years of dividend payments. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. C-Com Satellite Systems is already paying out 110% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

The Bottom Line

Should investors buy C-Com Satellite Systems for the upcoming dividend? Not only are earnings per share declining, but C-Com Satellite Systems is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. This is a clearly suboptimal combination that usually suggests the dividend is at risk of being cut. If not now, then perhaps in the future. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Want to learn more about C-Com Satellite Systems's dividend performance? Check out this visualisation of its historical revenue and earnings growth.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance