Disney's (DIS) Ant-Man Beats Projections for Opening Weekend

Disney DIS recently released its new movie Ant-Man and the Wasp-Quantamania. The studio had estimated a $95 million to $100 million opening weekend which has surpassed more than $100 million.

Quantamania received poor critics' reviews which also included the lowest review for a Marvel movie by CinemaScore and Rotten Tomatoes which showed 48% of the critics gave the movie a positive review.

On the contrary, 84% of the audience had a favorable view of the movie on Rotten Tomatoes. The numbers also show that the audience has a positive review of the film, unlike the critics.

This was the third film in the Ant-Man franchise. The franchise has seen incremental growth in its films. The first movie was released in 2015 earning $57 million in its opening weekend followed by $76 million for the second installment in 2018.

All of these films featured Paul Rudd and Michael Douglas as the main characters. Usually, this franchise is known for its breezy characters but this film also featured Kang, the next supervillain for Marvel which had its own demands.

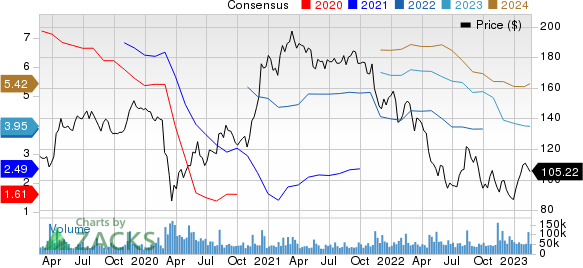

The Walt Disney Company Price and Consensus

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

Disney’s Upcoming Projects to Boost Revenues

Moviegoers are expected to keep rising in 2023. While 2022 saw a strong rebound with a return of big-ticket movies in theatres, this momentum is expected to carry in 2023. This would have a favorable impact on the top-line growth of the company in 2023. Disney’s last-quarter revenues were $23.51 billion, up 8% year over year.

Marvel being one of the largest movie franchises has grouped its movies into phases. Ant-Man and the Wasp-Quantamania announced the start of phase five for Marvel. Phase 5 includes over twelve movies and series which will be released by the end of 2024.

Other big movies to release in 2023, which will boost the top line for Disney, are Chevealier, Guardians of the Galaxy Vol.3, The Little Mermaid, The Boogeyman, Indiana Jones and The Dial of Destiny and many more.

The management recently announced that they would start giving dividends again by the end of 2023. Dividends were a key part of Disney which was stopped in 2020, owing to the financial condition of the company during the pandemic.

Disney also expects to reduce annualized non-content-related expenses by roughly $2.5 billion. It also expects $3 billion of annualized savings in non-sports-related content spending.

Management expects overall cost savings to be $5.5 billion over the next few years. This is likely to aid bottom-line growth for the company which came in at 99 cents per share in the first-quarter fiscal 2023.

Zacks Rank & Stocks to Consider

Disney currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some top-ranked stocks in the Consumer Discretionary sector are Century Casinos CNTY, Liberty Media FWONK and Imax Corporation IMAX. While Century Casinos sports a Zacks Rank #1, Liberty Media and IMAX carry a Zacks Rank #2 (Buy) at present.

Shares of Century Casinos have declined 9.5% in the past year. Its earnings are estimated to be 2 cents per share, which has fallen from 5 cents per share over the past 30 days.

Shares of Liberty Media have increased 11.1% in the past year. The Zacks Consensus Estimate for earnings is pegged at $0.09 per share, which has remained unchanged over the past 30 days.

Shares of IMAX have fallen 16.8% in the past year. The Zacks Consensus Estimate for earnings is pegged at $0.15 per share, which has risen from $0.14 over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Century Casinos, Inc. (CNTY) : Free Stock Analysis Report

IMAX Corporation (IMAX) : Free Stock Analysis Report

Liberty Media Corporation (FWONK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance