This Dirt-Cheap Warren Buffett TSX Stock Should Be Your Top Pick

Several provinces and territories across Canada have started to open up, and travel restrictions are slowly being lifted. Despite the uplifting morale from economies reopening, the demand for oil has yet to make it to pre-pandemic levels. Subsequently, the energy sector is not soaring to unimaginable heights or even recovering as fast as the broader economy.

While the S&P/TSX Composite Index is up by more than 37% from its March 23, 2020 bottom, oil companies continue to perform poorly due to a lack of demand. Heavy players in the industry are still well below pre-pandemic levels, but Suncor Energy Inc. (TSX:SU)(NYSE:SU) is among the worst of the lot.

Is it a dirt-cheap stock you should grab shares of or a bust? Today I will discuss Suncor and why it might be an excellent investment right now.

Calgary-based oil giant

At writing, Suncor is trading for $23.16 per share, and is paying its shareholders with a decent 3.63% dividend yield. The stock is well below its 2020 peak of $45.12 per share. Since the market began to recover, Suncor has climbed 53.68%.

Its current dividend yield is low due to the company slashing its dividend in half. While Suncor lost its Dividend Aristocrat status with the move, it might not be all bad news for investors.

The dividend cut disheartened many investors, but the bigger picture might make it look like a smart move. The company made its dividends more sustainable by slashing them preemptively due to its current losses.

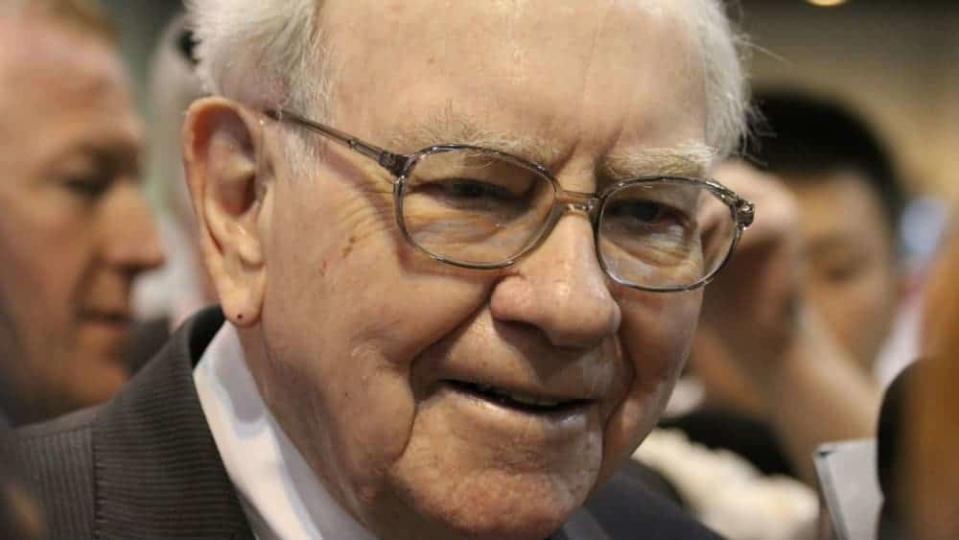

The Oracle of Omaha — and Suncor

Warren Buffett is widely considered to be the world’s most successful investor. Investors look up to him for his mysterious ability to make excellent picks in the stock markets for terrific long-term gains time and time again. Famously known for investing primarily in American companies, Buffett chose to invest in Suncor as one of his latest major acquisitions.

The Oracle of Omaha considers Suncor among his favourite energy picks. He bought into the company for the first time in 2013, removed his position in the stock four years ago, and suddenly made a move to purchase 1% of the company in 2019. Despite the pandemic, Buffett continues to hold on to Suncor shares in his portfolio.

Buffett has other energy companies in his portfolio, but his interest in Suncor has confused investors. Investing in oil sands might make it a confusing pick for many investors. Despite its substantial presence in the industry and reputation for being a defensive player in the market due to its integrated operational structure, Suncor can be more of an attractive pick than most of its competitors.

Foolish takeaway

Despite being a fully integrated energy company with several downstream operations to its advantage, Suncor has taken a massive beating between the oil price war and pandemic. The company reported a $3.5 billion loss in its Q1 2020 earnings report. Many investors are hopeful that the oil giant will regain its dominance when demand returns to pre-pandemic levels.

I think Warren Buffett’s faith in Suncor is not misplaced. You can consider investing in the stock for its highly discounted share prices and bank on making substantial profits with its capital gains.

In the meantime, you can continue growing your wealth through its more sustainable dividend payouts.

The post This Dirt-Cheap Warren Buffett TSX Stock Should Be Your Top Pick appeared first on The Motley Fool Canada.

More reading

CRA Update: a Brand-New $500 Tax Break You Can Claim in 2020!

Air Canada (TSX:AC) Stock Owners: Mark This Thursday on Your Calendar!

Fool contributor Adam Othman has no position in any of the stocks mentioned.

The Motley Fool’s purpose is to help the world invest, better. Click here now for your free subscription to Take Stock, The Motley Fool Canada’s free investing newsletter. Packed with stock ideas and investing advice, it is essential reading for anyone looking to build and grow their wealth in the years ahead. Motley Fool Canada 2020

Yahoo Finance

Yahoo Finance