Do Directors Own Nevada Energy Metals Inc. (CVE:BFF) Shares?

The big shareholder groups in Nevada Energy Metals Inc. (CVE:BFF) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.'

Nevada Energy Metals is not a large company by global standards. It has a market capitalization of CA$1.0m, which means it wouldn't have the attention of many institutional investors. In the chart below below, we can see that institutional investors have not yet purchased shares. Let's delve deeper into each type of owner, to discover more about BFF.

Check out our latest analysis for Nevada Energy Metals

What Does The Lack Of Institutional Ownership Tell Us About Nevada Energy Metals?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

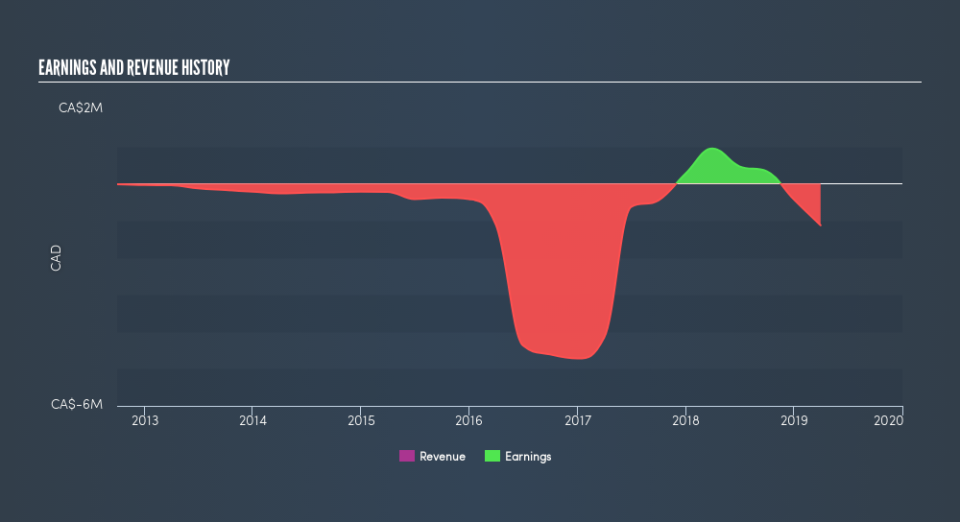

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Nevada Energy Metals, for yourself, below.

We note that hedge funds don't have a meaningful investment in Nevada Energy Metals. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Nevada Energy Metals

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Nevada Energy Metals Inc.. Insiders have a CA$171k stake in this CA$1.0m business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 84% stake in BFF, suggesting it is a fairly popular stock. This level of ownership gives retail investors the power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow .

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance