Digital Turbine (APPS) Q4 Earnings In Line, Revenues Rise Y/Y

Digital Turbine APPS reported fourth-quarter fiscal 2020 non-GAAP earnings of 5 cents per share, which matched the Zacks Consensus Estimate and increased 66.7% from the year-ago quarter.

Revenues of $39.3 million beat the consensus mark by 3.6% and came ahead of the guided range of $33.2 million to $34.5 million. Revenues increased 44.7% year over year, primarily driven by higher revenue per device (RPD) from U.S.-based carrier partners and incremental contributions from newer platform products.

However, the growth was partially offset by weakness in advertising demand amid the coronavirus outbreak as high-profile multinational advertising companies across categories including brands, games, and mobile first applications reduced capital expenditure due to business uncertainties.

U.S. RPD at the four largest tenured U.S.-based partners increased 35% year over year. International business grew more than 85% in the quarter.

Digital Turbine’s mobile device management platform, Ignite, has gained significant traction. As of Jun 2, 2020, more than 405 million devices had Ignite installed, including more than 40 million devices installed during the fiscal fourth quarter.

Notably, the company completed its acquisition of Mobile Posse, Inc., on Feb 28, 2020. Notably, results for the fourth-quarter fiscal 2020 include the results of the acquired Mobile Posse operations from Feb 28, 2020 through Mar 31, 2020.

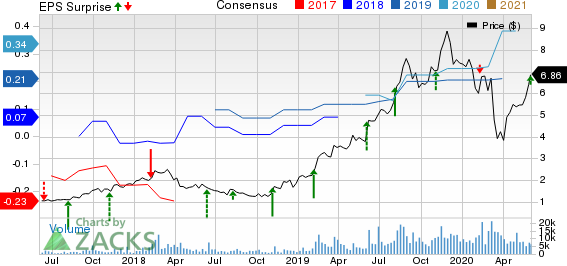

Digital Turbine, Inc. Price, Consensus and EPS Surprise

Digital Turbine, Inc. price-consensus-eps-surprise-chart | Digital Turbine, Inc. Quote

International Partnerships

Revenues derived from international partners grew 80% year over year driven by Samsung and America Movil among others and represented 20% of application business revenues compared with 9% in the year-ago period.

Notably, the company’s software was installed on more than 10 million unlocked Samsung devices across more than 75 countries at the end of the fiscal fourth quarter.

Additionally, revenues generated from initial U.S. partners — Verizon VZ, AT&T T, Cricket and U.S. Cellular — increased year over year and represented 70% of total revenues, compared with 90% in the year-ago period.

At the end of fourth-quarter fiscal 2020, the company’s diversified partner base included T-Mobile TMUS, a large content business partner, and rollouts with newer U.S.-based partners such as Tracfone.

Content products represented 25% of revenues while other application products, such as Single-Tap, Folders, Notification and wizard contributed to 15% of revenues in the fourth quarter of fiscal 2020.

Moreover, this Zacks Rank #3 (Hold) company continued integration with new demand sources from SingleTap partners like AppsFlyer, Branch and Kochava. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Operating Details

Non-GAAP gross margin contracted 160 basis points (bps) on a year-over-year basis to 40%.

On a GAAP-basis, product development expenses increased 37.2% to $3.7 million. Sales & marketing (S&M) expenses increased 48.3% to $3.7 million. General & administrative (G&A) expenses rose 30.7% to $4.9 million.

Operating expenses, as percentage of revenues, contracted 170 bps on a year-over-year basis to 31.5%.

Operating income on a GAAP basis was $2.9 million in the reported quarter. The company had reported operating income of $1.93 million in the year-ago quarter.

Balance Sheet & Cash Flow

The company's cash balance was $21.5 million as of Mar 31, 2020 compared with $25.2 million as of Dec 31, 2020.

As part of the close Mobile Posse transaction, the company paid $41.5 million in cash at closing, funded with $20 million of new term loan financing and the balance funded from existing cash balances at close.

Cash provided by operating activities totaled $13.5 million in the reported quarter compared with $8.4 million in the previous quarter.

Non-GAAP free cash flow was $11.8 million in the reported quarter compared with $7.02 million in the prior quarter.

Guidance

For first-quarter fiscal 2021, Digital Turbine expects revenues between $47 million and $50 million.

The Zacks Consensus Estimate for revenues is currently pegged at $41.8 million.

Non-GAAP adjusted EBITDA is expected between $8 million and $10 million.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATT Inc. (T) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

TMobile US, Inc. (TMUS) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance