Did You Miss Sea's (NYSE:SE) Impressive 141% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Sea Limited (NYSE:SE) share price has soared 141% in the last year. Most would be very happy with that, especially in just one year! Also pleasing for shareholders was the 89% gain in the last three months. Sea hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Sea

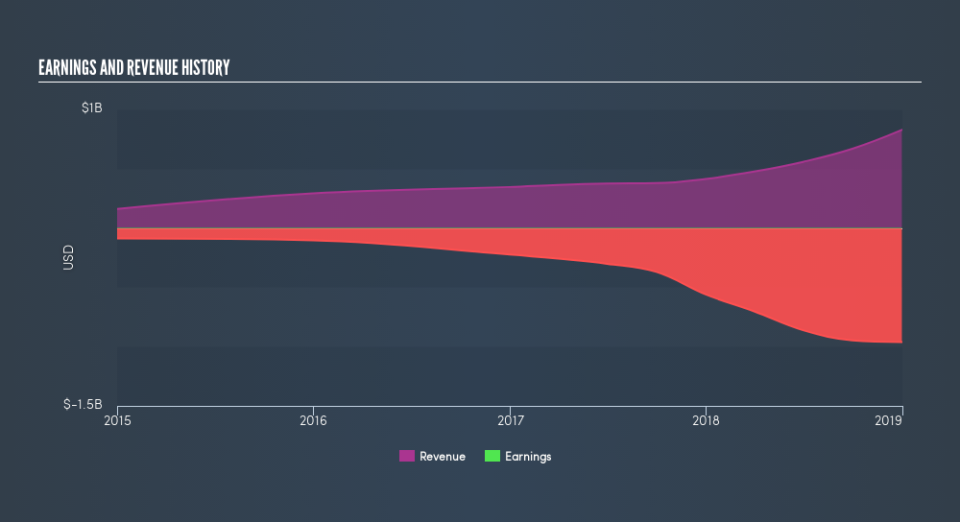

Sea isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Sea grew its revenue by 100% last year. That's well above most other pre-profit companies. Meanwhile, the market has paid attention, sending the share price soaring 141% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Sea shareholders should be happy with the total gain of 141% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 89% in that time. This suggests the company is continuing to win over new investors. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Sea may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance