Did You Miss GDI Integrated Facility Services' (TSE:GDI) 98% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at GDI Integrated Facility Services Inc. (TSE:GDI), which is up 98%, over three years, soundly beating the market decline of 2.9% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 12% in the last year.

See our latest analysis for GDI Integrated Facility Services

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years of share price growth, GDI Integrated Facility Services actually saw its earnings per share (EPS) drop 15% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

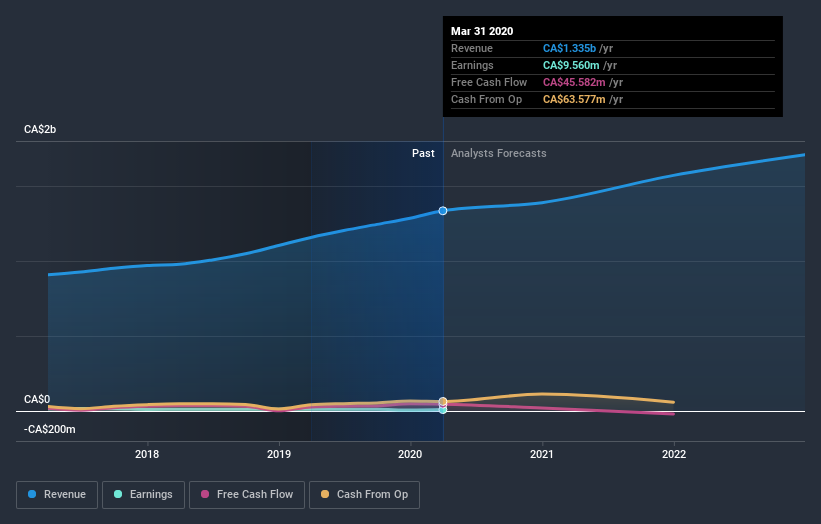

It could be that the revenue growth of 14% per year is viewed as evidence that GDI Integrated Facility Services is growing. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that GDI Integrated Facility Services shareholders have received a total shareholder return of 12% over one year. That's better than the annualised return of 9.6% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with GDI Integrated Facility Services (including 1 which is is a bit concerning) .

But note: GDI Integrated Facility Services may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance