Did You Miss ATI Airtest Technologies's (CVE:AAT) 40% Share Price Gain?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the ATI Airtest Technologies Inc. (CVE:AAT) share price is 40% higher than it was a year ago, much better than the market return of around 5.4% (not including dividends) in the same period. So that should have shareholders smiling. Having said that, the longer term returns aren't so impressive, with stock gaining just 17% in three years.

Check out our latest analysis for ATI Airtest Technologies

ATI Airtest Technologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

ATI Airtest Technologies grew its revenue by 20% last year. That's a fairly respectable growth rate. Buyers pushed the share price 40% in response, which isn't unreasonable. If revenue stays on trend, there may be plenty more share price gains to come. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

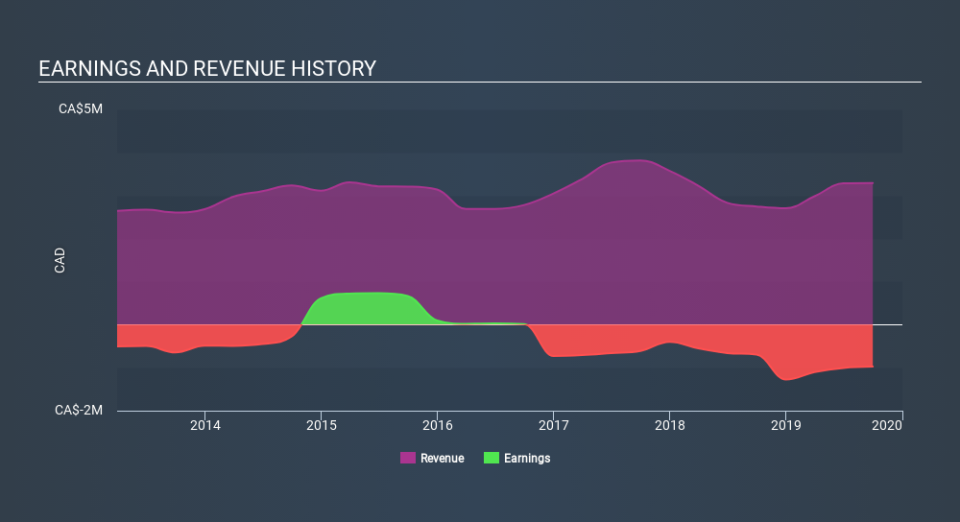

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at ATI Airtest Technologies's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that ATI Airtest Technologies shareholders have received a total shareholder return of 40% over one year. That's better than the annualised return of 3.1% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that ATI Airtest Technologies is showing 7 warning signs in our investment analysis , and 4 of those are potentially serious...

Of course ATI Airtest Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance