Did You Manage To Avoid Seven Generations Energy's (TSE:VII) Devastating 73% Share Price Drop?

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of Seven Generations Energy Ltd. (TSE:VII) investors who have held the stock for three years as it declined a whopping 73%. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 43% in a year. It's down 1.0% in the last seven days.

View our latest analysis for Seven Generations Energy

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Seven Generations Energy became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

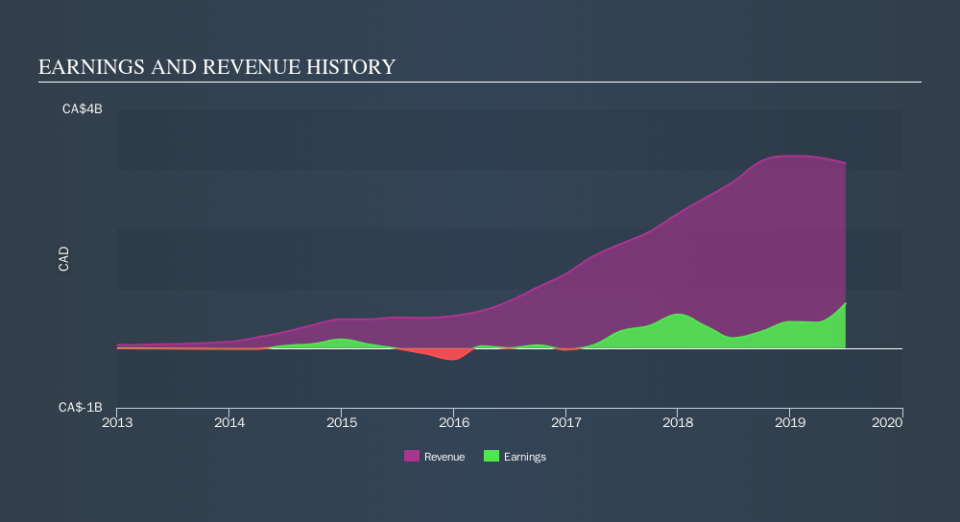

We note that, in three years, revenue has actually grown at a 40% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Seven Generations Energy further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Seven Generations Energy in this interactive graph of future profit estimates.

A Different Perspective

Investors in Seven Generations Energy had a tough year, with a total loss of 43%, against a market gain of about 8.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 20% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Seven Generations Energy by clicking this link.

Seven Generations Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance