Did Changing Sentiment Drive Nielsen Holdings's (NYSE:NLSN) Share Price Down A Worrying 56%?

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term Nielsen Holdings plc (NYSE:NLSN) shareholders. Unfortunately, they have held through a 56% decline in the share price in that time. On the other hand, we note it's up 8.2% in about a month.

View our latest analysis for Nielsen Holdings

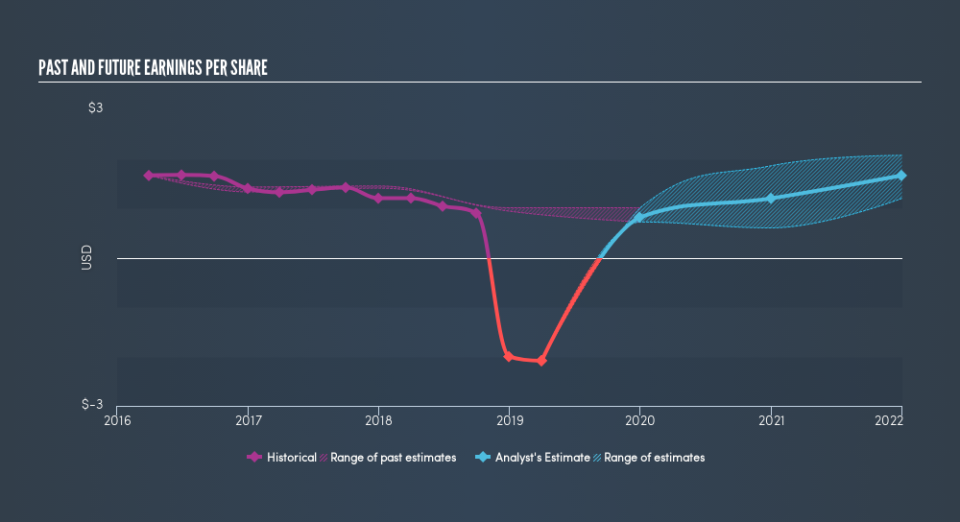

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Nielsen Holdings saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Nielsen Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Nielsen Holdings, it has a TSR of -50% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Nielsen Holdings shareholders have received a total shareholder return of 14% over the last year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 9.3% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before spending more time on Nielsen Holdings it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance