Did Changing Sentiment Drive Leucrotta Exploration's (CVE:LXE) Share Price Down A Worrying 67%?

Leucrotta Exploration Inc. (CVE:LXE) shareholders will doubtless be very grateful to see the share price up 41% in the last quarter. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 67% in the last three years. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

Check out our latest analysis for Leucrotta Exploration

Given that Leucrotta Exploration only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Leucrotta Exploration saw its revenue grow by 37% per year, compound. That is faster than most pre-profit companies. In contrast, the share price is down 31% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

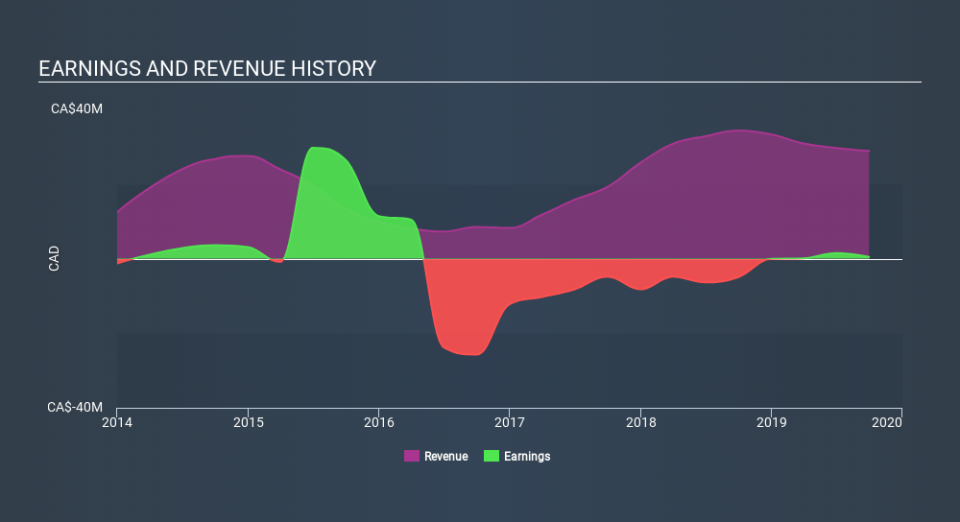

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in Leucrotta Exploration had a tough year, with a total loss of 22%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6.4% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Leucrotta Exploration that you should be aware of.

Leucrotta Exploration is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance